APR vs. APY Crypto: Which is Higher?

When diving into the world of crypto savings accounts, DeFi lending, or staking, you’ll often see terms like APY and APR thrown around. At first glance, they may seem interchangeable—but they're not. Understanding the difference between APY and APR can help you make smarter financial decisions and maximize your crypto yields.

In this guide, we’ll break down APY vs APR in crypto, explain how each works, and show you when to use one over the other.

What Does APR (Annual Percentage Rate)Mean?

APR (Annual Percentage Rate) is the simple interest rate you earn or pay over a year, without factoring in compounding.

In crypto, APR is commonly used in:

- Lending platforms (e.g., supplying USDC to Aave)

- Crypto credit cards

- Fixed-interest staking pools

If you stake your tokens and the platform offers a 10% APR, it means you’ll earn 10% interest over the year—assuming you don’t reinvest your rewards.

Key characteristics of APR:

- Does not include compounding

- Useful for comparing loans or borrow rates

- Simpler to calculate than APY

- Can underestimate your true earnings

What Does APY Mean (Annual Percentage Yield Explained)

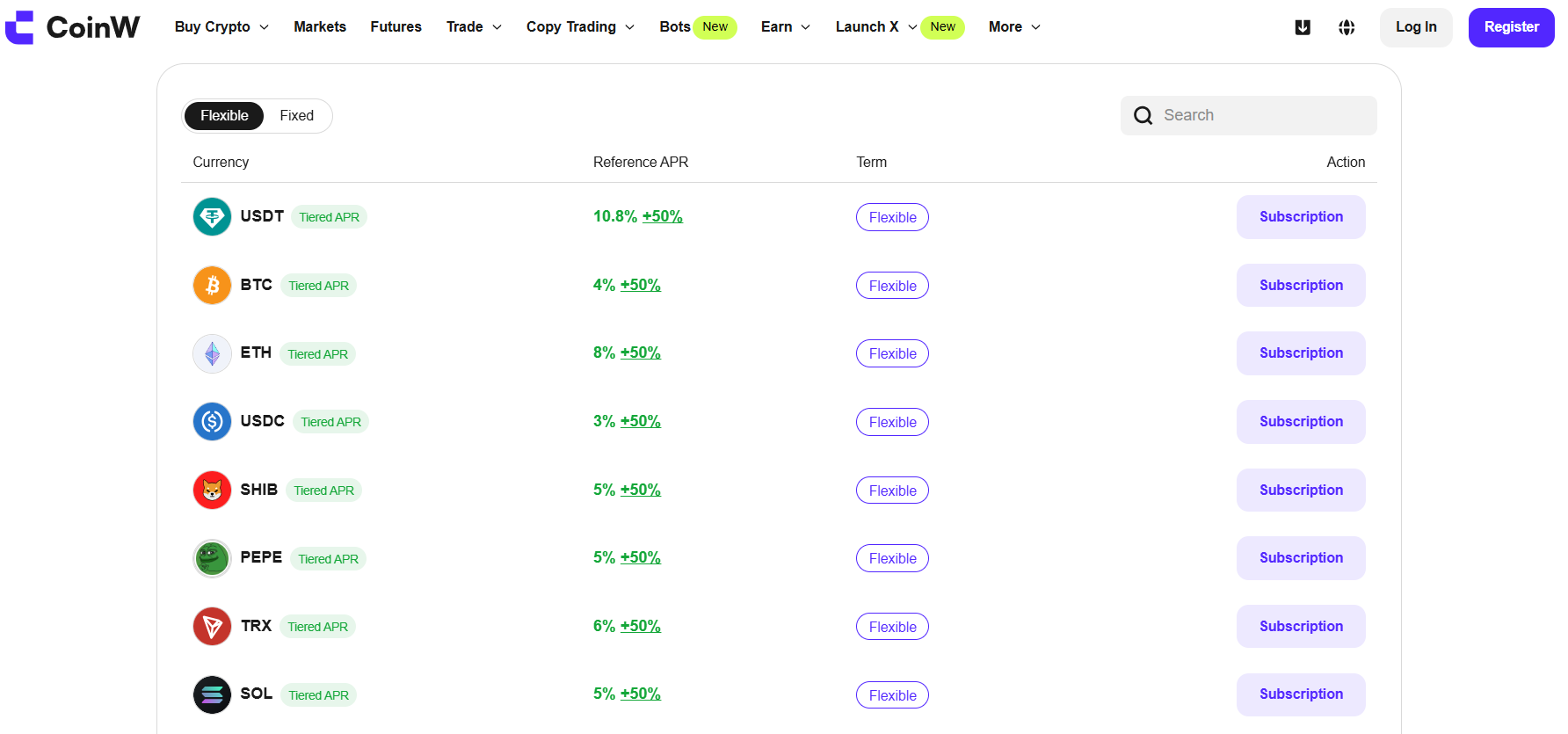

CoinW Earn products offer competitive APYs.

APY (Annual Percentage Yield), on the other hand, includes compound interest—meaning it assumes your rewards are continuously reinvested.

In crypto, APY is often used to describe returns from:

- DeFi staking platforms

- Yield farming protocols

- Interest-bearing crypto wallets

For example, if you earn 10% APY on a DeFi platform, and it compounds weekly or daily, your actual return will be slightly higher than 10% due to the effect of compounding.

Key characteristics of APY:

- Includes compounding

- Reflects realistic returns if you reinvest

- Can be higher than APR even with the same base rate

- Common in DeFi and staking platforms

In other words, APY is the effective annual rate, or real rate, of return of an investment, and gives you a more accurate calculation of the returns on your investment.

Imagine you had $1,000 to invest and there was a product that gave you 5% APR, with monthly compounding interest. By the end of the first year, you will have pocketed more than $1,050. In fact, you would have about $1,051.16. In other words, your APY would have been 5.1162%.

This may not be much higher than 5.0%, but if you extrapolate the period of investment, or began with a larger initial sum this small amount ends up making a big difference!

APY vs APR: Key Differences

| Feature | APR | APY |

| Compounding | Not included | Included |

| Common Use Cases | Loans, fixed staking, borrow | DeFi yield, savings, farming |

| Reflects Real Return | No | Yes |

| Crypto Examples | Lending on Compound | Staking on Lido, Farming on Yearn |

The core difference between APR and APY boils down to compounding. If you're comparing two crypto platforms, one offering 10% APR and the other 10% APY, the APY option will yield more over time—especially with frequent compounding.

Here is a table that shows the compounding effect for APY based on different compounding frequencies:

| Compounding Frequency | APY |

| Annually | 5% |

| Semi-annually | 5.06% |

| Quarterly | 5.12% |

| Monthly | 5.12% |

| Daily | 5.126% |

When Should You Use APY vs APR in Crypto?

Knowing when to use APY or APR depends on whether you're earning or borrowing crypto—and whether compounding is involved.

Use APR when:

- Borrowing crypto (e.g., taking a loan on Aave)

- Comparing base interest rates

- Evaluating platforms with non-compounding rewards

Use APY when:

- Evaluating staking, yield farming, or DeFi vaults

- You're reinvesting your rewards

- Comparing compound interest returns across platforms

How to Calculate APY and APR

Now that you’re clear about the difference between APR and APY, you will be better equipped to determine which crypto product out there will be a better investment. Here are some guidelines:

When comparing different products, say one with returns in APR and another with returns in APY, you need to convert both to APY in order to make a correct comparison i.e. apples to apples, oranges to oranges.

When comparing different products, both with the same APR, you need to check if the interest is compounded daily/weekly/monthly/yearly. The more frequent the compounding is, the higher the APR is. This is why some crypto platforms stress that their earn products are “compounded daily” to offer a more attractive promise of returns.

Various free online tools make it easy for you to convert APR into APY and vice versa; all you need to do is to enter the frequency of compounding for whichever platform you are researching.

APY vs APR: Crypto Lending, Staking & Yield Farming

1. Crypto Lending (e.g., Aave, Compound)

- Lenders earn APR

- Borrowers pay APR

- Often no automatic compounding unless reinvested

2. Staking (e.g., Ethereum on Lido, Solana)

- Returns shown as APY

- Compounding frequency varies by protocol

3. Yield Farming (e.g., Curve, SushiSwap, Yearn)

- Uses APY, as it assumes rewards are reinvested

- Watch out for daily/weekly compounding boosts

Earn competitive crypto APY on your idle assets.

FAQs About APY vs APR in Crypto

Is a higher APR always better?

Not necessarily. If another platform offers a slightly lower APR but compounds frequently (and shows APY), the effective return may be higher.

Why is APY higher than APR?

Because APY includes the effect of compounding, it naturally ends up higher than APR if interest is paid more than once per year.

Should I always choose APY-based platforms in DeFi?

If you're compounding rewards automatically or frequently, APY gives a more realistic picture of your earnings. Just make sure to factor in gas fees and impermanent loss.

Final Thoughts: APY vs APR—Which One Matters More?

In the world of crypto, both APY and APR are essential metrics—but for different reasons. APR helps you compare base interest rates on loans or fixed-term staking, while APY gives a more accurate view of your potential earnings if compounding is involved.

Pro tip: Always check whether the rate shown is APR or APY before committing your crypto. It could make a big difference in your returns—especially in volatile or high-yield DeFi environments.

Other Considerations

Alas, if only it were as simple and straight-forward as choosing the product with a higher APY. This is because there are other factors to consider, such as the below, which will impact your final returns.

- Fees:Some products may charge fees that reduce your overall return, such that even if you chose a product with a higher APY, it may ultimately not yield you that much in the end.

- Risk of the product: Cryptocurrency investments often come with varying levels of risk. Some investments may offer higher APYs but if you factor in the risk involved, it may not be a wise choice. This is most commonly seen when comparing the usually lower BTC staking returns with that of some newly launched altcoin, which is more susceptible to hype or even rug-pulls.

You May Also Like

What Is a Stop-Limit Order in Crypto Trading?

Stop-limit orders in crypto let you control your entry and exit prices by combining a trigger (stop) and a limit. Learn how to set them up on CoinW for smarter, safer trading.

What Are Iceberg Orders in Crypto Trading?

Iceberg orders let crypto traders split large orders into smaller ones to reduce market impact, limit slippage, and stay hidden from other traders. Here’s how it works.

What Is a Bear Trap in Crypto Trading?

Learn what a bear trap is in crypto trading, how it works, and how to avoid getting caught when Bitcoin and altcoins fake a market breakdown.