Crypto Trading with AI for Beginners

Getting started with cryptocurrency trading can feel like stepping into a whirlwind. Prices move quickly, strategies sound complicated, and it’s not always clear where to begin. The good news is, you don’t need to figure everything out on your own.

Artificial intelligence (AI) is becoming a popular tool in the crypto world, helping traders simplify decision-making and automate strategies. Instead of spending hours glued to charts, AI bots can manage trades for you — whether your goal is steady growth, maximizing profits, or simply learning the ropes without taking on too much risk.

This guide walks through the different types of AI-powered trading strategies available on platforms like CoinW, explains what each one is best for, and helps you decide which might fit your trading style.

How Does Crypto Trading with AI Work?

Crypto trading with AI for beginners involves using artificial intelligence and automation to execute trading strategies without constant manual input. AI bots analyze vast amounts of market data in real-time, identifying trends, signals, and patterns—then act on them automatically. This level of speed, analysis, and trade execution is simply not achievable for most human traders.

With AI, emotional trading—or making decisions based on fear or greed—is significantly reduced, leading to more disciplined execution.

Why Beginners Should Consider AI Trading Bots

As mentioned above, most disciplined traders can miss opportunities or fall victim to emotion. This is where AI trading bots step in. By blending automation with intelligence, they give beginners a chance to participate in the markets with tools once reserved for professionals. Far from replacing human judgment, these bots act as tireless allies, bridging the gap between inexperience and execution.

Specifically, here’s how AI can give traders a turboboost:

- 24/7 Market Monitoring

AI bots work non-stop, ideal for the always-on crypto markets, ensuring no opportunity is missed. - Enhanced Speed & Precision

AI reacts to fleeting market movements within seconds—much faster than any human can. - Automated Risk Management

Tools like dynamic stop-loss strategies and position sizing, underpinned by AI, help manage volatility and exposure. - User-Friendly for Beginners

Many platforms, including CoinW, offer intuitive interfaces, templates, and strategy ‘blueprints’ that make launching into AI trading approachable—even for novices.

Step-by-Step Starter Guide: Crypto Trading with AI for Beginners

1. Head to the CoinW Trading Bots page, a central hub detailing trading bots like Grid strategies, Martingale, Spot Grid, Auto-Invest, and more—perfect for beginners to explore and experiment.

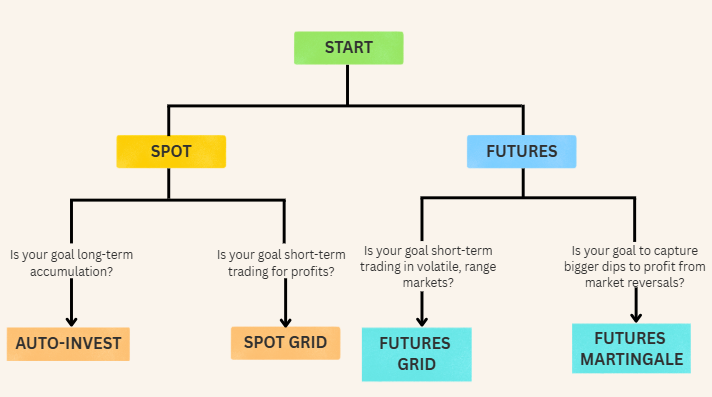

2. Select your strategy from a range of structured strategy options:

- Futures Grid: Automates buy-low, sell-high transitions—great for volatile markets

- Futures Martingale: Helps scale in during dips to lower average purchase prices

- Spot Grid: Applies a grid strategy to spot trading

- Auto-Invest: Enables recurring buys for dollar-cost averaging and long-term growth

3. Choose and configure a bot: set your entry/exit parameters and risk tolerance. Begin small to get comfortable.

4. Monitor performance and refine strategy—bots should be adjusted, not forgotten. Combine with sound risk management.

5. Alternatively, try CoinW’s GPT-TradeAI which delivers real-time market analysis and personalized trade suggestions designed to enhance your strategy.

Tips & Warnings for Beginners

For beginners stepping into AI-powered trading, one golden rule stands above all: always manage risk wisely. While these bots can automate decisions and react faster than humans, they are not foolproof. Technical glitches, misjudged signals, or sudden market swings can still lead to losses. That’s why disciplined strategies—such as setting stop-loss orders and defining clear position limits—remain essential safeguards.

It’s also important to recognize the limits of AI. Algorithms can only work with the data they’re given, and that data may be incomplete, biased, or overly optimistic. Factors such as tax implications or liquidity constraints often lie beyond an AI’s scope. In other words, AI can be a powerful assistant, but its guidance should never be followed blindly.

Finally, security must always come first. Since trading bots require access to your exchange account, only trust reputable platforms like CoinW, and take full advantage of protective measures such as strong passwords and two-factor authentication (2FA). These small but critical steps ensure that your venture into AI trading remains both exciting and safe.

In Conclusion

Choosing the right AI bot really comes down to your goals and comfort level. If you’re looking to steadily grow your holdings over time, something like Auto-Invest can help you stay disciplined without overthinking the market. If you prefer more hands-on trading, Spot Grid or Futures strategies may suit you better — depending on how much risk you’re willing to take.

The most important part is to start small, learn how the tools work, and find what feels right for you. AI can take a lot of the guesswork out of trading, but your strategy should always match your personal goals and risk tolerance.

Whether you’re here to build for the long term or test out faster-moving markets, AI trading bots can be a helpful guide on your crypto journey. Start here: Trade crypto with AI.

You May Also Like

What Is a Stop-Limit Order in Crypto Trading?

Stop-limit orders in crypto let you control your entry and exit prices by combining a trigger (stop) and a limit. Learn how to set them up on CoinW for smarter, safer trading.

What Are Iceberg Orders in Crypto Trading?

Iceberg orders let crypto traders split large orders into smaller ones to reduce market impact, limit slippage, and stay hidden from other traders. Here’s how it works.

What Is a Bear Trap in Crypto Trading?

Learn what a bear trap is in crypto trading, how it works, and how to avoid getting caught when Bitcoin and altcoins fake a market breakdown.