What is the Bitcoin Liquid Network?

Bitcoin, the OG crypto, is known for being sturdy and secure. But it is precisely because of these features that it isn’t as fast or scalable as some newer blockchains like Ethereum and Solana. Bitcoin’s robust security comes at the cost of slow transaction speeds, making everyday payments and high-frequency trades less practical.

In response, developers have created several Bitcoin Layer 2 solutions, including the Liquid Network, a Bitcoin sidechain designed to make transactions faster, cheaper, and more private. In this article, we’ll break down what the Liquid Network is, how it works, and why it’s an exciting solution for scaling Bitcoin.

What is the Liquid Network in Bitcoin?

The Liquid Network is a Bitcoin sidechain developed by Blockstream in 2018. It’s a Layer 2 solution that helps streamline Bitcoin transactions by enabling faster settlements, lower fees, and the issuance of assets like stablecoins and security tokens. Think of it as Bitcoin’s DeFi layer, designed to bring faster and more confidential transactions to Bitcoin users.

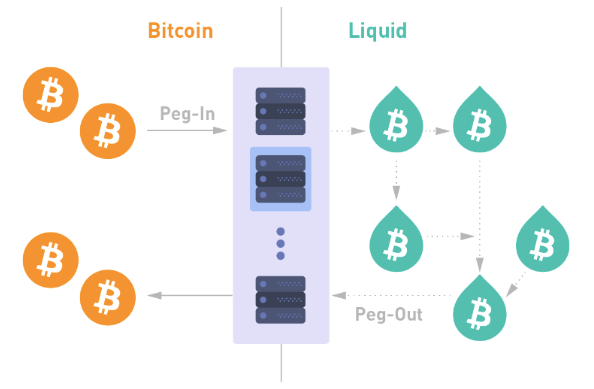

The Liquid Network operates with Liquid Bitcoin (L-BTC)—a token pegged 1:1 to regular Bitcoin (BTC). When you move BTC to the Liquid sidechain, you receive L-BTC, which you can use for quick and private transfers. You can always convert L-BTC back to BTC at the same rate.

Here’s an analogy:

Moving BTC to the Liquid Network is like exchanging cash for arcade tokens (L-BTC). You can spend them within the arcade (Liquid Network) and exchange them back to cash (BTC) when you leave.

How Does the Liquid Network Work?

BTC holders can easily peg in and peg out of Liquid BTC to perform transactions (Source: Blockstream)

The Liquid Network is governed by a federation of participants, including crypto exchanges, financial institutions, and Bitcoin-focused companies. It operates on an open-source platform called Elements, which enables features like confidential transactions and fast block finality.

Its key features:

- Liquid Bitcoin (L-BTC): A 1:1 pegged token representing BTC on the Liquid Network.

- Two-minute block times: Transactions are confirmed in just two minutes, compared to Bitcoin’s average 10-minute block time.

- Confidential transactions: Users can obscure transaction amounts and asset types for greater privacy.

- Asset iissuance: The network supports the creation of tokens like stablecoins and security tokens.

Benefits of Bitcoin’s Liquid Sidechain

Using the Liquid Network offers several advantages over the Bitcoin main chain:

- Faster Bitcoin Transactions: Bitcoin transactions on Liquid settle in about two minutes, making it ideal for traders, exchanges, and users who need quick transfers.

- Lower Bitcoin Fees: Moving transactions to the Liquid sidechain helps reduce congestion on the Bitcoin mainnet, leading to lower fees.

- Enhanced Privacy: Optional confidential transactions can hide the amount and type of asset being transferred.

- Asset Issuance and Management: Users can issue new tokens on Liquid, supporting Bitcoin’s growing role in decentralized finance.

- Fungibility: All L-BTC tokens are equal and fully backed by BTC, ensuring trust and usability within the network.

- Federated Security: A trusted group of Liquid Federation members secures the network, balancing decentralization with efficiency.

Liquid Network vs. Lightning Network: Key Differences

Bitcoin’s Lightning Network and the Liquid Network are both Layer 2 solutions, but they serve different purposes. Here's how they differ:

In short, Liquid is better for large, private transactions and asset issuance, while Lightning excels in instant micropayments.

How to Use the Bitcoin Liquid Network

There are two main ways to access and use the Liquid Network:

1. Using a Liquid Wallet

This is the simplest option for most users. Several wallets support Liquid Bitcoin (L-BTC) transactions, including Blockstream Green (Blockstream Green wallet). These wallets handle the complexities of interacting with the Liquid sidechain for you.

- Download a Liquid-compatible wallet like Blockstream Green.

- Create a Liquid address for receiving L-BTC.

- Buy L-BTC on supporting exchanges or peg-in BTC using services like Sideswap.

2. Running a Liquid Node

This option offers more control and functionality but requires technical expertise. Here's what's involved:

- Download Elements Core to operate a full Liquid node.

- Requires technical setup and blockchain syncing.

- Benefits: More control, ability to verify transactions, and even issue your own assets.

Important: Regardless of the method you choose, it's crucial to research and understand the risks involved before using the Liquid Network. Since it's a sidechain, security relies on a federated peg system, which introduces different risks compared to the main Bitcoin network.

Is the Liquid Network Safe for Bitcoin Transactions?

The Liquid Network’s security model differs from Bitcoin’s main chain. It relies on a federated peg system where a group of trusted institutions validate transactions and manage the transfer of BTC to and from the sidechain.

While the federated model offers faster settlement and privacy, it introduces a degree of trust not required on the fully decentralized Bitcoin mainnet. However, Liquid is still considered a secure and reliable solution for many use cases, especially when privacy and speed are priorities.

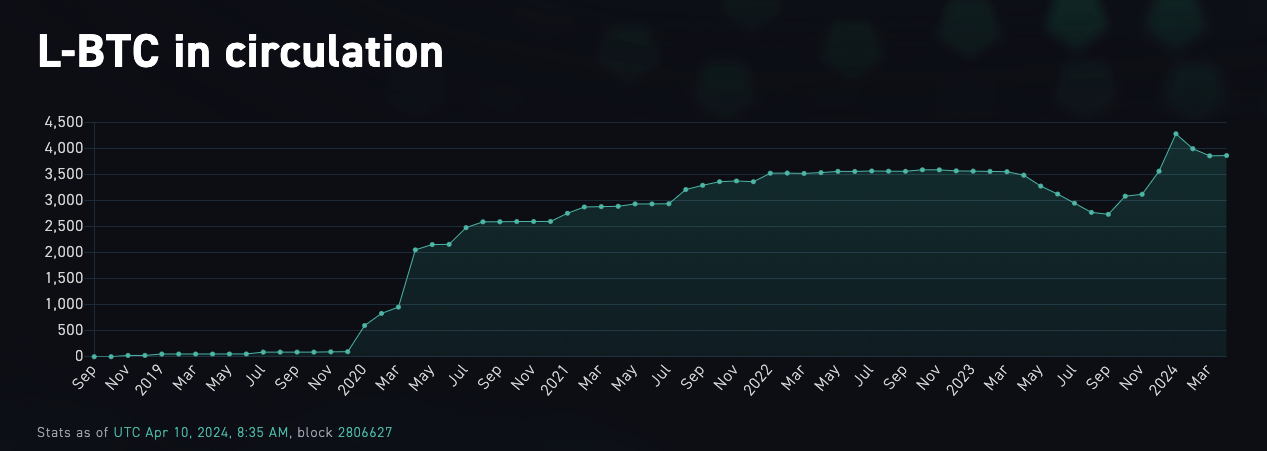

Liquid Network Growth and Future Potential

Since its 2018 launch, the Liquid Network has continued to grow, with major exchanges and platforms integrating it. Notably:

- Bitfinex and BitMEX support Liquid-based trading.

- Bitmatrix, a decentralized exchange, joined the federation in 2022.

- More stablecoins and security tokens are being issued on Liquid.

Looking ahead, Liquid is working on greater interoperability with other blockchains and atomic swaps to enable faster cross-chain transfers without intermediaries. If Bitcoin adoption grows, Liquid’s role as a scalable settlement layer could become even more significant.

In Conclusion

The Liquid Network is a powerful Bitcoin sidechain that helps streamline Bitcoin transactions, offering faster speeds, lower fees, and enhanced privacy. Compared to the Lightning Network, Liquid is more suited for large settlements, asset issuance, and private transactions.

As the Bitcoin ecosystem matures, the Liquid Network’s potential to scale Bitcoin for wider adoption is becoming harder to ignore. For users looking for faster Bitcoin settlements and advanced features like confidential transactions and asset issuance, the Liquid Network is a solution worth exploring.

You May Also Like

What are Liquidity Pools in DeFi?

Here's how liquidity pools work and how you can earn passive income by providing liquidity.

What is cryptocurrency?

A beginner-friendly explanation of what cryptocurrency is, and how it differs from digital cash.

What is UTXO in Bitcoin?

Discover what UTXOs are in Bitcoin, how they work, and why they are essential for understanding Bitcoin transactions and wallet balances.