What is Dollar-Cost Averaging (DCA) in Crypto?

Trying to time the market can be incredibly frustrating and futile, especially when it comes to highly volatile assets like Bitcoin. Novice traders are particularly susceptible to the pitfalls of market timing, often getting caught up in buying high and selling low due to FOMO (fear of missing out) or panic.

In their eagerness to capitalize on a rising market, they may buy into an asset at its peak, only to see its value plummet shortly after. Then they panic-sell at a loss, only to watch in dismay as the asset appreciates in value again.

What if there was a way you could protect yourself against the emotional highs and lows of market timing? Enter dollar-cost-averaging, a simple yet effective investment strategy that requires only one thing–level-headed discipline.

What is the DCA Strategy in Crypto?

DCA, or dollar-cost averaging into crypto, is a strategy for investing in which you buy a fixed amount of an asset at regular intervals, regardless of the asset's price. In other words, you invest the same amount of money every week or month, instead of trying to time the market and invest a lump sum all at once.

By investing a fixed amount of money on a regular basis, investors can gradually build their position in a cryptocurrency, regardless of the current price. This can help to reduce the risk of using up all your capital to buy a crypto, then seeing the price drop and having no more money to buy the dip.

How to Start DCA in Crypto?

To set up a DCA plan for your crypto investments, here are the 3 things you need to decide:

- Investment amount: First, decide how much you want to invest. This should be an amount you're comfortable with, and can afford to lose if things go south (which they sometimes do in the world of crypto).

- Investment frequency: Next, choose a frequency of investment - weekly, bi-weekly, or monthly are all common options.

- Investment duration: Finally, set up your start and end dates for your purchases on your favorite crypto exchange (make sure it’s a reputable one with strong security measures and an auto-invest feature, like CoinW.com.)

Most of these auto-invest platforms come with built-in tools to calculate the average cost of your crypto, so you do not need to worry about complicated formulas or spreadsheets!

Start dollar-cost averaging with CoinW.

Is it Better to DCA or Do a Lump Sum Strategy?

As with many big questions when it comes to finance and investing…it depends. To make DCA work for you as opposed to following a lump sum strategy, here are some factors to consider:

- Your investment horizon: If you are investing for the long term, then the DCA strategy may be a better choice, as it can help to smooth out the volatility of the market.

- Your risk tolerance: If you are risk-averse, then the DCA strategy may be a better choice, as it can help to reduce your chances of buying at a high price.

- Your available funds: If you have a lump sum of money available to invest (which you do not need anytime in the next 5 to 10 years and can afford to lose), then the lump sum strategy may be a better choice, as it has the potential to generate higher profits.

DCA-ing into Crypto: An Example

Let’s compare two friends:

A) Lump Sum Larry: Invests the full $12,000 in January when Bitcoin is priced at $40,000.

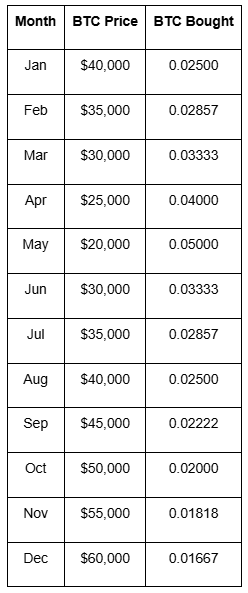

B) DCA Dana: Invests $1,000 per month from January to December, regardless of Bitcoin’s price.

Lump Sum Larry

January BTC price: $40,000

Buys: $12,000 ÷ $40,000 = 0.3 BTC

No further purchases.

DCA Dana

Let’s say BTC price changes monthly like this:

Total BTC accumulated: ≈ 0.34087 BTC

Final Value (Assuming BTC is $60,000 in December)

A) Larry’s BTC: 0.3 × $60,000 = $18,000

B) Dana’s BTC: 0.34087 × $60,000 = $20,452

Key takeaways:

DCA Dana ends up with more BTC and higher portfolio value, even though she started buying when the price was high.

Lump Sum Larry bought all at once at $40,000 and missed the chance to buy at lower prices.

DCA helped smooth out market volatility and build a better average cost per BTC.

Is DCA a Good Crypto Strategy?

Dollar-cost averaging (DCA) is widely considered a smart and beginner-friendly strategy for crypto investing—especially in a market known for its volatility. Rather than trying to time the market (which even seasoned investors struggle to do), DCA allows you to invest a fixed amount of money at regular intervals, regardless of the coin’s price. Over time, this approach helps smooth out the impact of price swings and lowers the average cost per coin.

DCA is especially effective in the crypto world because it removes emotional decision-making. Instead of panic-buying during bull runs or selling during dips, you're sticking to a disciplined plan. This makes it easier to stay invested long-term and benefit from the overall growth of the crypto market.

While DCA doesn’t guarantee profits, it significantly reduces the risk of making a big investment at the wrong time. For long-term believers in assets like Bitcoin or Ethereum, DCA offers a practical way to build a position gradually—without the stress.

Bottom line? If you're looking for a low-stress, consistent way to invest in crypto, DCA is one of the best strategies to consider.

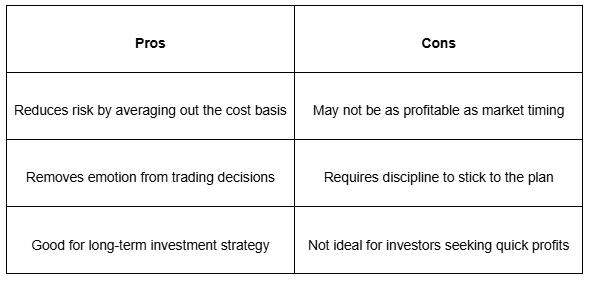

However, there’s no perfect strategy. There are some disadvantages to the DCA strategy, and we’ve laid it out in this table for your easy comparison.

Conclusion

DCA is a smart strategy not just for beginners but serious long-term crypto investors. It helps to mitigate risk, removes the pressure to time the market perfectly, and can lead to a solid portfolio over time. Again, no investment strategy is foolproof, but if you set realistic goals (don't expect to get rich overnight), stay disciplined and consistent with your investments and invest responsibly (i.e. with cash that you do not need to pay the bills next month!), you will find that DCA is a good strategy to remove a lot of the risk that comes with crypto trading.

Check out CoinW’s Auto-Invest/DCA plan.

You May Also Like

The Ultimate Guide to Cryptocurrency Swing Trading

Swing traders are like surfers on the ocean: we do not try to control the sea, nor do we want to stay in the water forever. Our goal is to identify an incoming wave, hop on the board, and gracefully head back to shore before the wave subsides.

TACO Trading: Trading Alongside President Trump

TACO Trading: Capturing the elasticity dividends between extreme panic and market recovery amidst the policy mists of 2026.

What Is a Stop-Limit Order in Crypto Trading?

Stop-limit orders in crypto let you control your entry and exit prices by combining a trigger (stop) and a limit. Learn how to set them up on CoinW for smarter, safer trading.