How to Stake Crypto

Crypto staking has become a popular way for investors to earn passive income on their holdings. But before you jump in, it's crucial to understand what staking is, the potential rewards and risks, and most importantly, the do's and don'ts.

What is Staking Crypto?

Imagine a bank that rewards you for simply holding your money there. That's essentially what staking does in the crypto world. In certain proof-of-stake (PoS) blockchains like Ethereum, Cardano and Solana, your crypto holdings contribute to the network's security and validation process. For this participation, you're rewarded with tokens, similar to earning interest on a savings account.

However, you might have noticed that there are staking programs even for blockchains that are not PoS, such as Bitcoin, which runs on Proof-of-Work (PoW). This is available mostly from platforms like exchanges, wallets or lending and borrowing protocols that are centralized, as they need the liquidity for these PoW tokens. This is a slightly different mode of staking, but the general concept is still the same, as far as the end user is concerned: you deposit your crypto assets, and earn passive income from it! Plus, unlike mining, staking doesn't require expensive hardware or technical expertise. Just hold your crypto and watch it grow.

How Much Can You Earn from Staking?

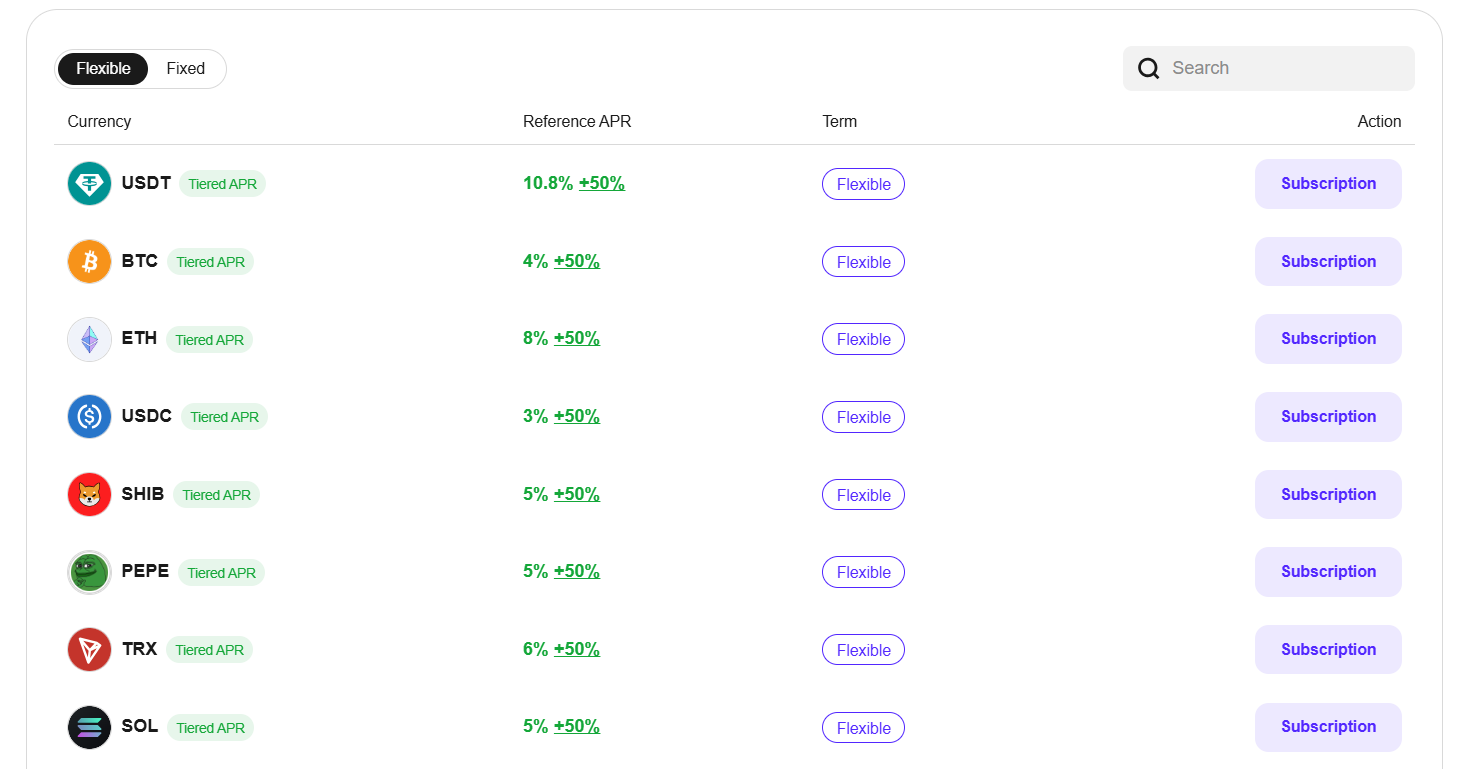

Staking events offered by CoinW as of 4 August 2025

The amount you can earn from crypto staking can vary greatly depending on several factors, namely:

- The specific cryptocurrency you stake: Different coins have different staking rewards, ranging from 0.5% to well over 20% APY (Annual Percentage Yield). Popular coins like Ethereum, Cardano, and Polkadot generally offer rewards between 5% and 20%.

- The method you use for staking: You can stake through a centralized exchange, a staking pool, or by becoming a validator yourself. Each method has its own pros and cons, and the rewards can vary depending on the platform or pool you choose. For example, some exchanges take a cut of your staking rewards, while others pass them on to you in full.

- Market conditions: The overall cryptocurrency market can affect staking rewards. When the market is bullish, staking rewards may be higher as demand for staking services increases. Conversely, during a bear market, rewards may decrease.

- The amount you stake: The more crypto you stake, the more rewards you will earn (assuming a constant APY).

In other words, these are the factors for consideration before you start staking your crypto assets. Here are some additional things to keep in mind:

- Staking rewards are usually paid out in the same cryptocurrency you are staking.

- Staking your crypto usually involves locking it up for a certain period of time.

- There is always a risk that the value of the cryptocurrency you stake could go down, even while you are earning rewards.

4 Do's of Crypto Staking:

Understand the lock-up periods: Some staking options require you to lock your crypto for a set period, often ranging from weeks to months. Ensure you're comfortable with the limitations before committing.

- Diversify your holdings: Don't put all your eggs in one basket. Spread your staking across different cryptocurrencies and platforms to mitigate risks.

- Consider the fees: Transaction fees and platform charges can eat into your staking rewards. Compare fees before choosing a platform.

- Stay informed: Keep yourself updated on the latest news and developments related to the cryptos you've staked. This knowledge can help you make informed decisions about your holdings.

5 Don'ts of Crypto Staking

- Chase overly high returns: Be wary of platforms offering unrealistic APYs (annual percentage yields). They might be indicative of risky or unsustainable practices - like the Terra Luna stablecoin collapse back in 2022.

- Invest more than you can afford to lose: Remember, the crypto market is volatile. Only stake what you're prepared to lose in case of price downturns.

- Ignore security: Always practice good security hygiene. Use strong passwords, enable two-factor authentication, and store your private keys securely.

- Overlook lock-up periods: Don't stake your crypto if you might need immediate access to it. Unexpected financial needs can lead to selling at a loss.

Additional tips:

- Start small and scale up as you gain experience and confidence.

- Do your own research (DYOR) before choosing any staking platform or crypto.

Conclusion

Think of it as a low-risk, high-reward way to boost your crypto game. Just remember to do your research, choose a reputable platform, and be patient as your rewards slowly accumulate. It's the crypto equivalent of planting a money tree and watching it bloom.

You May Also Like

Crypto Weekly Report (Mar 2 - 8 , 2026) : Capital Outflows Intensify & Structural Divergence in Public Chains

The global crypto market cap rose 0.85% to $2.37 trillion this week, with continuous net inflows into BTC and ETH ETFs, while market sentiment remained in extreme fear and all new stablecoin supply came from USDC. The on-chain ecosystem saw structural divergence with mild growth in DeFi and Layer2 TVL, a strong surge in Sui’s activity, weakened performance of Solana and other public chains, as well as intensive launches of new projects, token issuances and airdrops.

PropW Introduction

PropW is a proprietary trading firm offering simulated trading challenges. Traders who pass these challenges will gain access to a funded simulated account and can earn rewards based on their trading performance.