Why HumidiFi (WET) is Solana's Prop AMM Game-Changer

Quick Summary: HumidiFi's private liquidity crushes traditional AMM flaws for seamless, efficient on-chain trading powered by $WET.

Tired of bots eating your trades and slippage killing your profits on Solana DEXs like Raydium? Enter HumidiFi (WET), the Prop AMM dark pool that's grabbed 25-35% of Solana's DEX volume since its 2025 launch. It delivers CEX-speed swaps without public pools.

This article breaks down what HumidiFi is, its killer team led by Kevin Pang and the problems it solves. It’s perfect for traders eyeing Solana's next DeFi wave.

What is HumidiFi (WET)?

HumidiFi is a proprietary AMM (Prop AMM) and dark pool DEX on Solana. It swaps public pools for active liquidity management that nails tight spreads and low slippage. The platform also delivers CEX-speed trades via private algos.

Launched June 2025, it exceeded $1 billion in daily trading volume which was around 35 percent on Solana DEXs.

It skips user deposits like Raydium/Orca, running a closed-loop system with Jupiter routing best prices stealthily. $WET token powers staking, fee rebates, and incentives. It has no heavy governance.

Who is Behind HumidiFi (WET)?

HumidiFi comes from Kevin Pang, a trading expert who's led teams at Paradigm and Jump Trading. He has solid high-frequency trading experience from firms like Citadel and SCP. The team has links with Temporal. It’s a Solana development powerhouse behind tools like Nozomi (transaction engine), Temporal, and Harmonic (block builder).

Jupiter founder Meow called them one of Solana DeFi's strongest technical teams. They mix pro market-making with deep-chain development to boost liquidity. This explains their quick volume dominance since their June 2025 launch.

The team likes to stay under the radar. They prioritize solid execution over buzz, which suits the dark pool DEX perfectly.

What Problems Does HumidiFi Solve?

HumidiFi zeros in on the big headaches of traditional AMMs like Raydium or Orca. These are sky-high slippage and chunky spreads that hit traders hard. This is especially when bots swarm public pools and amplify market impact on big orders.

It flips the script with creator-managed liquidity and dark pool privacy. Trades are kept hidden to slash price swings and boost capital efficiency. It also handles massive volumes without the usual chaos on Solana.

This means way cheaper, lightning-quick swaps. Transactions are routed smartly through aggregators like Jupiter, making it feel just like CEX execution but stay fully on-chain.

No more MEV exploitation or front-running nightmares. Instead, pros get institutional-grade fills while retail enjoys seamless access.

Why is HumidiFi Highly Anticipated?

HumidiFi captured over 25 percent of Solana's DEX volume recently. This translated to billions in trades processed due to its superior microstructure innovations.

Its fair launch via Jupiter's DTF platform emphasizes community access and on-chain vesting for transparency. No VC private sales.

Listing on CoinW alongside prior crypto platforms boosts liquidity and exposure for traders eyeing Solana's DeFi surge.

WET Token Price and Market Info

WET boasts a fixed max supply of 1,000,000,000 tokens on Solana (SPL standard). At the time of writing, the price of WET trades near US$0.15-0.16 per token.

CoinW's listing enhances accessibility, with presale raises hitting $4.4M and predictions eyeing potential breakouts.

WET Tokenomics

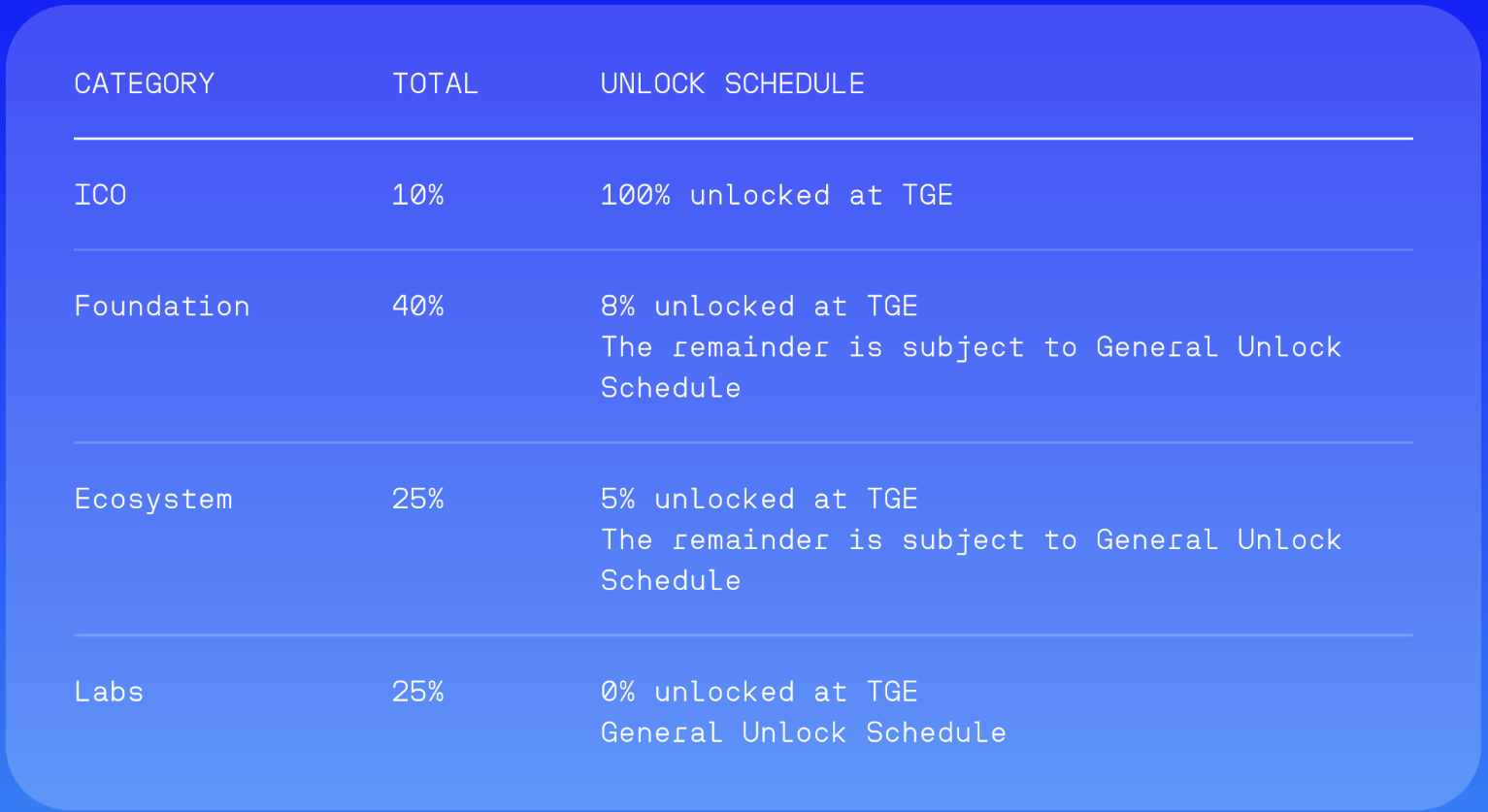

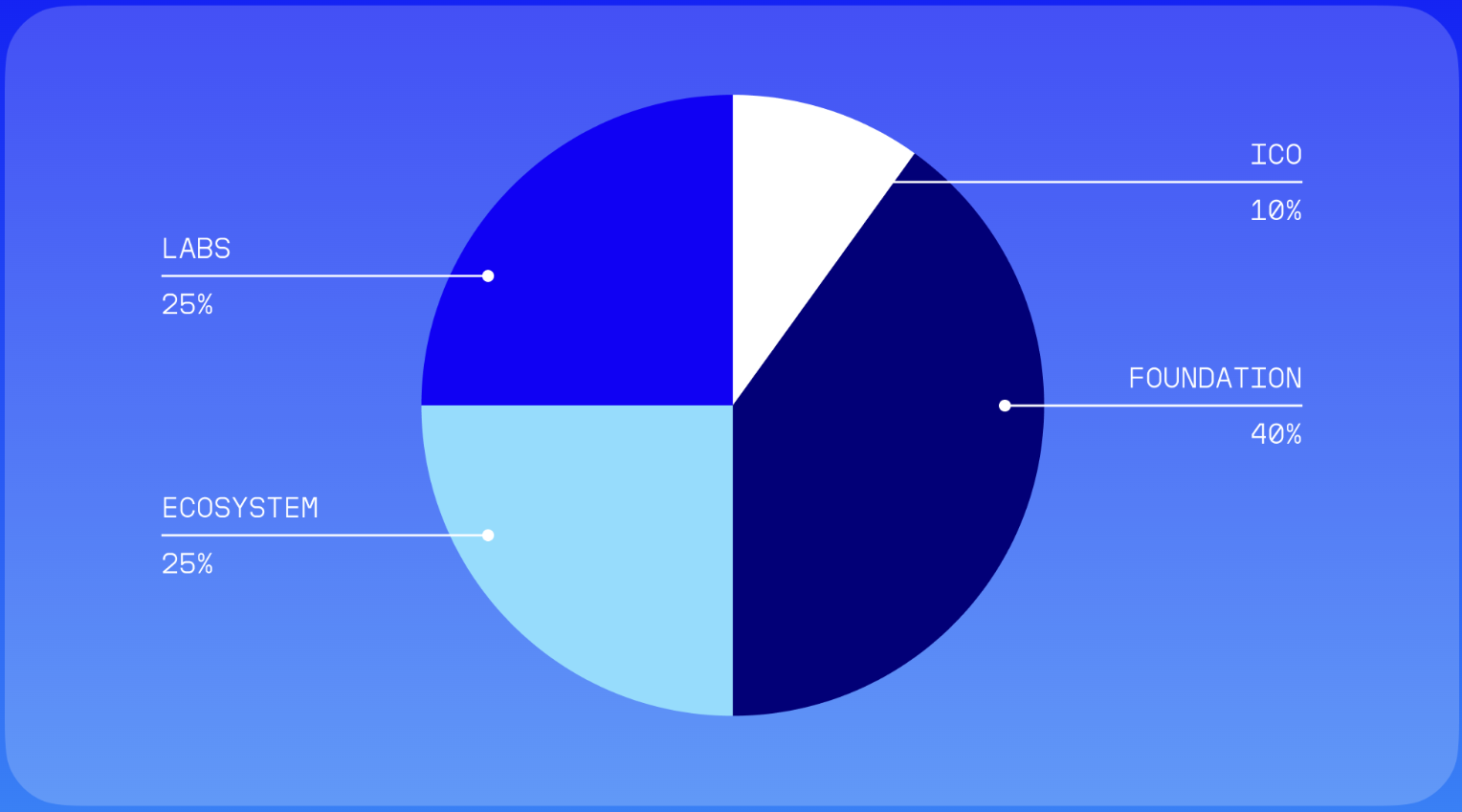

HumidiFi's $WET token dropped via Jupiter’s Decentralized Token Formation (DTF) platform. Yes, it's the very first one there which keeps things super transparent on-chain with easy controls.

Trading kicked off right at the Token Generation Event (TGE) last December 5, 2025, straight on HumidiFi and Meteora. Presale spots went to Wetlist wallets (6% for the whitelisted via Jupiter DTF). Among these were also HumidiFi users, active contributors, Discord crew, Jupiter stakers (2%). The public (2%) also had a first-come-first-served opportunity.

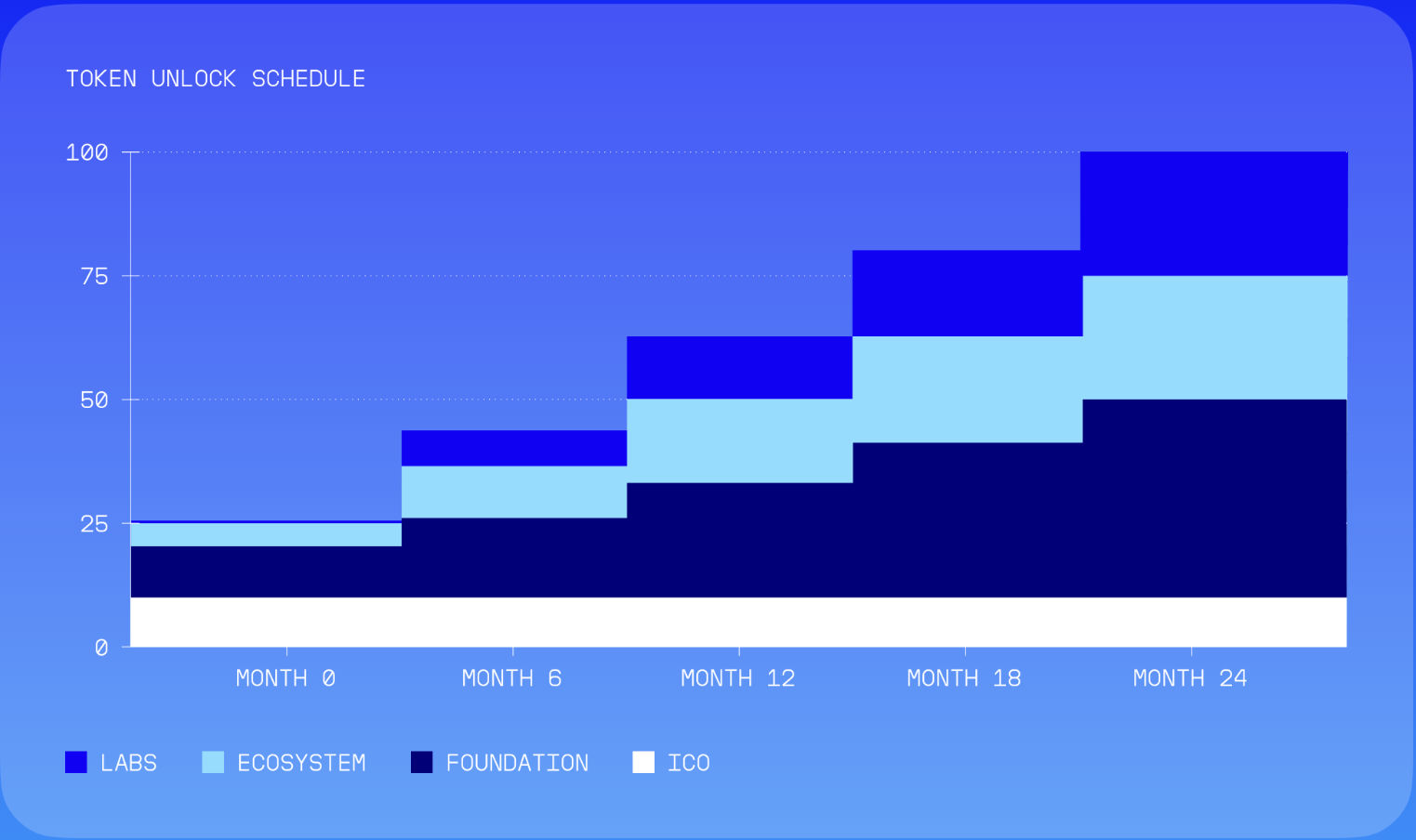

Unlocks happen nice and steady. Proportional releases every six months over two years from TGE. So no big insider dumps to worry about.

It's all about engaging with the community and ecosystem for real long-term vibes on Solana. No inflation here either, keeping that scarcity tight for the DEX action.

Join the HumidiFi bounty program and share a 13,000 USDT reward!

Conclusion

HumidiFi (WET) revolutionizes Solana DeFi with Prop AMM and dark pool tech. It reduces slippage and delivers CEX-speed trades on-chain via Jupiter. Led by Kevin Pang, it's captured 25-35% DEX volume since 2025.

As dark pools emerge like prediction markets, HumidiFi leads the pack as the top project to watch and learn from. Keep an eye on it.

Buy HumidiFi (WET) easily and securely on CoinW.

FAQs

1. What blockchain powers WET?

WET runs on Solana as an SPL token, leveraging its high-speed, low-fee network to fuel HumidiFi's Prop AMM.

2. When was WET listed on CoinW?

WET was listed on December 9, 2025.

3. How does HumidiFi differ from Uniswap?

Prop AMM uses private liquidity vs. public pools. It slashes slippage via active management.

4. Is WET inflationary?

No, fixed 1B supply ensures scarcity.

5. Where can I trade WET now?

You can trade WET on reputable exchanges such as CoinW.

6. What risks come with WET?

As a fresh DEX token, WET faces high volatility from market swings and early hype.

About CoinW

Founded in 2017, CoinW is a leading global cryptocurrency asset trading platform with intelligent trading services, average daily volumes of over $5 billion, and 10+ million users. Learn more at the site, follow on X, or join Telegram for updates.

You May Also Like

What is Bitcoin?

A 30,000-feet view of what Bitcoin is and how it went from "internet money" to a global top 10 asset.

What Is Ethereum?

Learn what Ethereum is in simple terms, and how its one key feature distinguishes it from Bitcoin.

What is Solana?

Should you invest in Solana? Get the lowdown on the altcoin making waves as the leading contender to dethrone Ethereum.