What are Liquidity Pools in DeFi?

If you've ever traded on a decentralized exchange (DEX) like Uniswap or SushiSwap, you’ve already interacted with a liquidity pool—even if you didn’t realize it. But what are liquidity pools, and why are they so important in crypto and DeFi?

In this article, we explain what liquidity pools are, how they work, and how you can participate in one to earn passive income. Let’s dive in (no pun intended).

What are Liquidity Pools?

Liquidity pools are smart contracts that hold token pairs, allowing users to trade directly without banks, brokers, or centralized exchanges. They power decentralized exchanges (DEXs) by enabling automated, permissionless crypto swaps, effectively creating the necessary liquidity for a crypto market.

In contrast, centralized exchanges don't necessarily need liquidity pools because they function through a different system: order books. These order books list buy and sell orders, with the exchange acting as a middleman using a matching engine to connect these buy and sell orders. By having a large user base actively trading, CEXs often have a natural level of liquidity built-in instead of depending on a liquidity pool.

Without this centralized order book, DEXs rely on automated market makers (AMMs), which use formulas based on the ratio of assets in a liquidity pool to determine exchange rates. Without these pools, AMMs wouldn't have the assets needed to facilitate trades.

This is why DEXs are often a launchpad for new crypto projects–liquidity pools provide a way for these new tokens to be easily traded, even if there isn't a large user base yet.

How Liquidity Pools Work

As mentioned above, liquidity pools are powered by Automated Market Makers (AMMs)—smart contracts that automatically set token prices based on supply and demand in the pool.

Here’s how it works:

1) Users add liquidity: Crypto holders contribute their assets (say, ETH and DAI) to a pool in equal value. They receive liquidity provider (LP) tokens representing their share of the pool. LP tokens are like your “receipts” for contributing assets to a pool. They represent your share of the pool and entitle you to a portion of the trading fees collected. You can trade LP tokens back for your original assets, plus any accrued fees.

2) Automated Market Making (AMM): Unlike traditional exchanges that match buyers and sellers, DEXs use AMMs. AMMs rely on formulas to determine exchange rates based on the ratio of assets in the pool, facilitating a fair trade. Think of it as a price scale automatically adjusting based on supply and demand within the pool.

3) Swapping assets: When a trader wants to swap tokens (e.g., ETH for DAI), the AMM uses the pool's assets to complete the trade. A small trading fee is collected, which goes back to the pool to incentivize liquidity providers.

This model eliminates the need for an order book and allows for 24/7, permissionless trading.

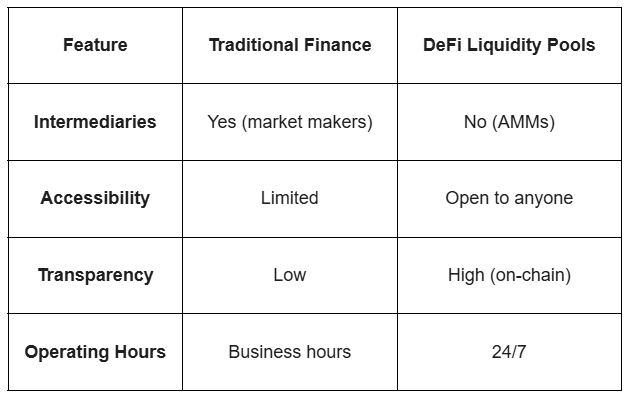

Decentralized Finance (DeFi) vs Centralized Finance (CeFi): Key Differences

How to Make Money from Liquidity Pools

Yes, this is the part we’ve all been waiting for. How to earn from liquidity pools? Here’s how: Liquidity pools offer the potential to make money through trading fees collected on each swap within the pool:

- Fees on swaps: Whenever a trade happens using the pool's assets, a small trading fee is deducted. This fee is typically a fraction of a percent (around 0.3% - 1%).

- Sharing the pie: The collected fees are distributed proportionally among all liquidity providers based on their share of the pool (represented by their LP tokens). The more LP tokens you hold, the larger your portion of the fees.

Here's an analogy: Imagine a toll booth on a bridge (the DEX). Cars (crypto swaps) pay a small fee to cross the bridge. The money collected is then distributed to the people who built and maintain the bridge (liquidity providers) based on how much they contributed (LP tokens).

Additional ways to potentially earn with liquidity pools include yield farming i.e. moving your crypto across different liquidity pools to maximize returns. You’re essentially “farming” for interest by providing liquidity across DeFi platforms.

There’s also liquidity mining i.e. when DeFi platforms reward liquidity providers with native tokens (e.g., UNI, SUSHI) on top of trading fees. It’s a popular strategy for earning passive income in DeFi.

Benefits of Providing Liquidity

- Passive income: Earn trading fees and token rewards just by locking your assets.

- Low barrier to entry: No need to be a pro trader or investor.

- Support the DeFi ecosystem: Your liquidity helps power decentralized apps and exchanges.

Risks of Liquidity Pools

Like everything in crypto, liquidity pools come with risks:

1) Impermanent Loss

This happens when the value of your deposited tokens changes significantly compared to when you first added them. You may end up with less than if you had just held the tokens.

2) Smart Contract Risk

DeFi protocols are built on code—and bugs or exploits can result in lost funds.

3) Low-Volume Pools

Pools with low activity can have high slippage and lower returns.

Finally, not all pools are created equal. Choose DEXs with established reputations and research pool fees and potential risks before participating.

How to Participate in Liquidity Pools

Here's a simplified roadmap to get you started:

1) Choose a DEX platform: Popular options include Uniswap, SushiSwap, and Curve (different platforms offer different pools, reward structures, and risk levels.)

2) Connect your crypto wallet: Most DEXs connect with popular wallets like MetaMask.

3) Find a liquidity pool: Look for pools with tokens you're interested in and research the fees and risks involved.

4) Add liquidity: Provide equal value of the two assets in the pool and receive LP tokens.

Before jumping in, here are some things to keep in mind:

- Choose well-audited protocols with strong reputations.

- Start with stablecoin pools (like USDC/DAI) if you're risk-averse.

- Always use a secure DeFi wallet like MetaMask or Rabby.

Track your LP tokens and understand the yield and risks involved. Remember: higher returns often come with higher risks.

In Conclusion

Liquidity pools are the lifeblood of DEXs. They enable the core functionalities of these platforms: permissionless trading, automated exchange through AMMs, and fostering a space for new tokens to gain traction. For crypto enthusiasts, liquidity pools can be a way to earn passive income from your crypto holdings; just be sure of the risks involved too!

You May Also Like

What is cryptocurrency?

A beginner-friendly explanation of what cryptocurrency is, and how it differs from digital cash.

What is UTXO in Bitcoin?

Discover what UTXOs are in Bitcoin, how they work, and why they are essential for understanding Bitcoin transactions and wallet balances.

Understanding On-Chain Analysis: A Guide for Crypto Investors

On-chain analysis is a powerful resource for crypto traders who want to trade based on pure hard data, not emotions. Here’s how to do it smart.