What are Maker and Taker Fees in Crypto Trading?

Maker and taker fees are the two main types of trading fees charged by cryptocurrency exchanges, every time you buy or sell crypto.

In this article, we explain what each type of fee is, why one is higher than the other, and of course, strategies to help you save on trading fees so that you can maximize your profits.

What are maker fees?

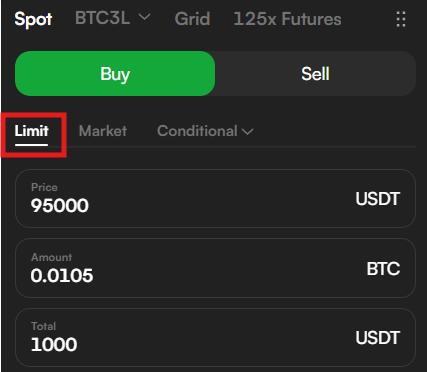

A maker fee is charged when a trader places a limit order, which is a new buy or sell order to be executed at a specific price level. This essentially adds liquidity to the order book by providing a market at that price level.

This is why maker fees are typically lower than taker fees–the whole purpose is to incentivize traders to place limit orders and increase liquidity on the exchange.

Maker orders are not executed immediately but wait in the order book until the market price reaches the specified limit price.

What are taker fees?

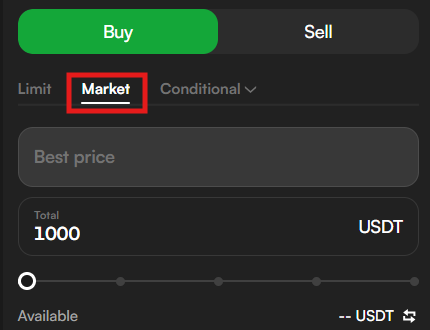

A taker fee is charged when a trader places a market order, which is a new buy or sell order to be executed instantly at the current price. This type of order removes liquidity from the order book and as such, taker fees are higher than maker fees since the trader is taking liquidity away from the market.

The specific maker and taker fees vary across different cryptocurrency exchanges, but taker fees are universally higher to compensate makers for providing liquidity. Higher trading volumes often qualify for lower maker and taker fees as an incentive.

Some of you might be thinking, what does it mean to add or take liquidity away from the market?

Well, to "add liquidity to the market" in the context of trading refers to placing orders that provide new buying or selling opportunities, rather than immediately executing against existing orders.

Specifically, adding liquidity means:

- Placing a limit order to buy or sell at a price level where there are no existing orders

- Your order gets added to the order book, providing new liquidity at that price level

- You are not immediately executing against an existing order, but rather creating a new order for others to potentially trade against. You can see this when your money is locked up, even though your order is not executed yet–it’s waiting for the price to reach the level you specified.

For example, if the current market price is $100, and the order book only has buy orders up to $99 and sell orders from $101 and above, placing a buy limit order at $100 or a sell limit order at $100 would add liquidity at that price level.

By adding these new orders to the order book, you are essentially advertising your willingness to buy or sell at those price levels, increasing the overall liquidity and trading opportunities in the market.

Traders who add liquidity are often rewarded with lower trading fees (maker fees) by exchanges, as they are providing valuable liquidity and trading opportunities to the market.

In contrast, immediately executing an order against the existing bids or asks removes liquidity from the market, which typically incurs higher fees (taker fees).

Here’s the thing that most beginner traders tend to ignore–the difference between maker and taker fees may seem slight when you compare them at face value, but higher taker fees can significantly increase your overall trading costs over time, especially for larger order sizes.

Trade with super-low 0.01% maker fees on CoinW

How to Calculate Maker and Taker Fees

Let's assume a scenario where you buy and sell a specific cryptocurrency on an exchange that charges maker and taker fees:

- You buy 0.1 units of a cryptocurrency at a price of $10,000 per unit (buy price).

- The exchange charges a maker fee of 0.25% on your buy order.

- Later, you sell those 0.1 units when the price increases to $10,500 per unit (sell price).

- The exchange charges a taker fee of 0.75% on your sell order.

Calculations

Total cost to buy (including maker fee):

- Buy_price * quantity_bought * (1 + maker_fee)

- $10,000 * 0.1 * (1 + 0.0025)

- = $1002.50

Total revenue from selling (excluding taker fee):

- Sell_price * quantity_sold

- $10,500 * 0.1

- = $1050.00

Taker fee incurred when selling:

- Total_sell_revenue * taker_fee

- $1050.00 * 0.0075

- = $7.875

Net profit: B - (A+C) = $1050.00 - ($1002.50 + $7.875) = $39.625

Percentage difference in profit (with vs. without fees):

- (profit_without_fees - total_profit) / profit_without_fees * 100

- ($50.00 - $39.625) / $50.00 * 100

- = 20.75%

In this example, even though the price of the cryptocurrency increased, a significant portion of your profit (20.75%) is eaten away by trading fees.

How to Minimize Trading Fees

Here are some effective strategies you can use to minimize taker fees when trading cryptocurrencies:

- Use limit orders instead of market orders: By placing limit orders, you become a market maker and pay the lower maker fees instead of the higher taker fees charged for market orders that remove liquidity.

- Trade on exchanges with lower taker fees: Compare the taker fee structures across different cryptocurrency exchanges and choose those with lower taker fees for your trading volume and style.

- Qualify for lower fee tiers: Many exchanges offer discounted taker fees for higher trading volumes through tiered fee structures. Increase your trading volume to move into lower fee tiers.

- Take advantage of fee discounts and promotions: Exchanges occasionally offer fee discounts or rebates. Stay updated and take advantage of these promotions to reduce your taker fees.

- Join exchange VIP/loyalty programs: High-volume traders may qualify for reduced taker fees by joining the VIP or loyalty programs offered by some major exchanges.

- Optimize order timing and size: Taker fees can be minimized by placing orders during periods of high liquidity and splitting large orders into smaller sizes to reduce market impact.

By implementing a combination of these strategies tailored to your trading needs, you can effectively reduce the taker fees paid and improve your overall trading profitability.

Register to trade on CoinW and receive up to 1,000 USDT in welcome bonus.

You May Also Like

The Ultimate Guide to Cryptocurrency Swing Trading

Swing traders are like surfers on the ocean: we do not try to control the sea, nor do we want to stay in the water forever. Our goal is to identify an incoming wave, hop on the board, and gracefully head back to shore before the wave subsides.

TACO Trading: Trading Alongside President Trump

TACO Trading: Capturing the elasticity dividends between extreme panic and market recovery amidst the policy mists of 2026.

What Is a Stop-Limit Order in Crypto Trading?

Stop-limit orders in crypto let you control your entry and exit prices by combining a trigger (stop) and a limit. Learn how to set them up on CoinW for smarter, safer trading.