Spot Trading vs. Futures Crypto Trading

Thinking about diving into crypto trading but not sure where to start? One of the first decisions you’ll face is choosing between spot trading and futures trading, and the difference isn’t just technical, it’s financial. From how you manage risk to the way profits (and losses) play out, spot trading vs futures trading crypto can feel like two entirely different worlds.

Understanding how each approach works will help you make smarter, more confident moves in the crypto market.

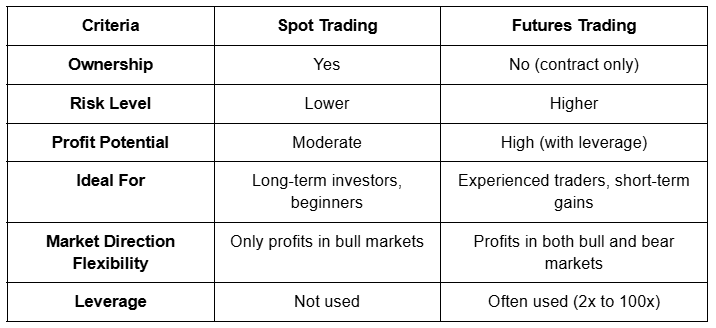

Spot Crypto vs Futures | Key Differences Explained

One of the biggest differences between spot trading and futures trading lies in how losses are handled.

In spot trading, you’re buying the actual cryptocurrency and holding it in your wallet. If the price drops, you only experience an unrealized loss. What this means is that your crypto has less value on paper, but you haven’t actually lost anything unless you sell at a lower price.

In futures trading, you’re entering a contract to speculate on the price of a crypto asset. These trades often use leverage, meaning you’re borrowing funds to increase your position size. If the market moves against you, and your losses reach a certain threshold, your position may be automatically liquidated, resulting in a realized loss, and your money is actually gone.

So, while spot trading gives you more flexibility to wait out market dips, futures trading carries higher risk and the potential for quick losses, especially if you don't manage your margin carefully.

Spot Trading vs. Futures Trading: A Visual Example

Imagine you buy 1 Bitcoin (BTC) for $30,000.

Spot Trading:

You actually own that 1 BTC. If the price falls to $20,000, your Bitcoin is now worth less on paper i.e. an unrealized loss of $10,000. But you still own the Bitcoin and can wait for the price to recover or sell whenever you want. You only lock in the loss if you sell at $20,000.

Futures Trading (with leverage):

Suppose you use 5x leverage and control 1 BTC worth $30,000 by only putting up $6,000 of your own money (margin). If the price drops 20% to $24,000, your position’s value drops by $6,000 (20% × $30,000). Since your margin was $6,000, you’ve lost it all i.e. a realized loss, and your position is liquidated. You don’t own Bitcoin; you’re trading a contract, and the leverage magnifies both gains and losses.

Trade BTC/USDT perpetual futures with ease on CoinW.

Is Spot Trading Better Than Future Trading?

The answer depends on your goals, experience level, and risk appetite. Spot trading is often considered better for beginners or long-term investors because it involves owning the actual cryptocurrency. You can buy, hold, and sell at your own pace,no pressure from margin calls or liquidation threats.

On the flip side, futures trading can offer higher returns in a shorter time, but that comes with greater complexity and risk. You’re trading contracts, not actual assets, and using leverage amplifies both your gains and losses.

Spot trading might be better if you:

-

- Want to build a long-term crypto portfolio

-

- Prefer lower risk and no liquidation

-

- Don’t want to deal with margin or leverage

Futures trading might be better if you:

-

- Are an experienced trader comfortable with risk

-

- Want to profit from both rising and falling markets

-

- Have a solid risk management strategy

What Are the Disadvantages of Futures Trading?

While futures trading in crypto offers big opportunities, it also comes with significant downsides that traders must understand before jumping in. Here’s what you have to pay attention to so you don’t lose all your capital:

-

- High risk of liquidation: If the market moves against your position, you can lose your entire margin. Some exchanges however, are providing liquidation coverage to traders as a benefit: check out Futures Trading Protection Program - Phase One | CoinW.

-

- Leverage can backfire: While leverage multiplies gains, it also multiplies losses.

-

- No ownership of assets: You don’t actually own any cryptocurrency — you’re just trading a contract based on its price.

-

- Requires advanced knowledge: Futures markets are not beginner-friendly. A lack of strategy or understanding can lead to costly mistakes.

Spot Trading vs Futures Trading: Which Is Better?

There’s no definitive winner in the spot trading vs futures trading crypto debate,only what’s better for you based on your needs.

In short, choose spot trading if you value simplicity, ownership, and long-term growth. Choose futures trading if you want more tools, higher risk/reward, and know how to manage volatility.

Still not sure? Many exchanges offer demo accounts for futures trading. Try one out without risking real money before going all in.

Choose the Tool That Matches Your Game

If you’re new to the market, trying to grow your capital steadily, or just looking to own crypto and sleep well at night, stick with spot trading. It teaches you the fundamentals, it’s safer, and it forces patience, which tbh is one of the most valuable skills in this space.

But if you’re serious about trading, have the discipline to manage leverage, and can handle stress without letting emotions run your trades, futures can be powerful. Just know this: it’s not a game. One mistake, one emotional trade, and your capital can vanish. Every pro trader has blown up an account. What separates the good from the great is learning the lesson without quitting.

So ask yourself honestly: Are you here to gamble, or to grow?

Use the tool that fits your journey, not the one that looks flashy. And no matter which path you choose, always manage your risk. Because in crypto, survival is the first step to success.

You May Also Like

The Ultimate Guide to Cryptocurrency Swing Trading

Swing traders are like surfers on the ocean: we do not try to control the sea, nor do we want to stay in the water forever. Our goal is to identify an incoming wave, hop on the board, and gracefully head back to shore before the wave subsides.

TACO Trading: Trading Alongside President Trump

TACO Trading: Capturing the elasticity dividends between extreme panic and market recovery amidst the policy mists of 2026.

What Is a Stop-Limit Order in Crypto Trading?

Stop-limit orders in crypto let you control your entry and exit prices by combining a trigger (stop) and a limit. Learn how to set them up on CoinW for smarter, safer trading.