What is UTXO in Bitcoin?

A UTXO (Unspent Transaction Output) is a fundamental concept in Bitcoin and many other cryptocurrencies that use the UTXO model.

Understanding UTXO is important to help you avoid hefty transaction fees when you spend or move your bitcoins around, and also protect your privacy and safety. It’s not just a topic for hardcore or super-savvy, technical Bitcoin HODLers, but for everyone who wants to be responsible and discreet in managing their sats.

In this article, we explain in greater detail what it is, and why it is important that you know about it, and what you should do in order to have good UTXO management.

UTXO vs Account

To borrow an analogy from Unchained.com, let's consider two different ways of storing cash: a bank account and a piggy bank.

When you deposit cash into a bank account, it gets mixed with all the other cash the bank holds. Since there are many customers, the bank doesn't keep each person's cash separate. Instead, they combine it and keep track of how much belongs to you.

Whether you deposit a $100 bill or 10 $10 bills doesn't matter. What matters is the total amount deposited. When you withdraw your $100, you might get a $100 bill, 2 $50 bills, or 100 $1 bills (of course, this last scenario is not likely; it’s for the sake of illustration only.)

Using a piggy bank is different. If you put five $20 bills into it, the $100 worth of contents remains as five $20 bills. If you withdraw the $100, you'll still have five $20 bills. However, if you want to pay someone $10 from the $100 in your piggy bank, there's an issue: your smallest bill is worth $20, so you'll need to find a way to get change.

The bank account model represents a custodial service where your cash is held for you, similar to how an exchange holds people's bitcoin—everyone's bitcoin is pooled together.

On the other hand, the piggy bank model represents cash in self-custody, which is the appropriate mental framework for understanding bitcoin in self-custody wallets.

There's a crucial distinction between depositing 1 BTC into your wallet in one transaction and depositing 0.1 BTC into your wallet 10 times. Despite the total being 1 BTC in both cases, each deposit remains a distinct entity within your bitcoin wallet. Each of these entities is referred to as a UTXO.

UTXO management: Why it's important to manage your UTXOs

(Source: Unchained)

Now that you know what a UTXO is, let’s explore why it’s important to know about it.

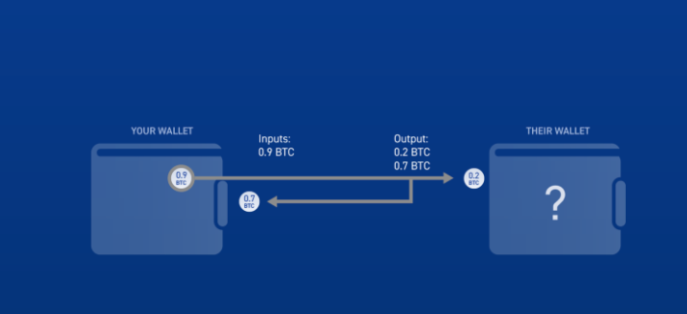

When a transaction is made, the sender takes one or more UTXOs from their wallet as inputs, signs the transaction with their private key to prove ownership, and creates new outputs - one for the recipient's address and the change back to the sender's address.

So, if you made 10 0.1 BTC deposits into your wallet, and now you want to pay someone 0.4 BTC, your transaction’s input data comprises 4 UTXOs (4 x 0.1). In contrast, if you had only made a one-time deposit of 1 BTC into your wallet, your transaction’s input data comprises only 1 UTXO. More data means higher fees, especially during periods of high network fees.

Having many small UTXOs in your wallet can result in larger transaction sizes when you want to spend your bitcoin. This is because each UTXO used as an input adds data to the transaction.

However, the story doesn’t end here.

As mentioned above, every transaction has an output–which has not been spent, and can be used as an input in a new transaction.

In the second scenario i.e. one-time deposit of 1 BTC, if the recipient of your 0.4 BTC tracks the transaction, he or she can see that the output was 0.6 BTC back to you–revealing your stack. In the first scenario i.e. 10 0.1 BTC deposits, the output back to you was zero, thus your stack of 0.6 BTC is kept secret.

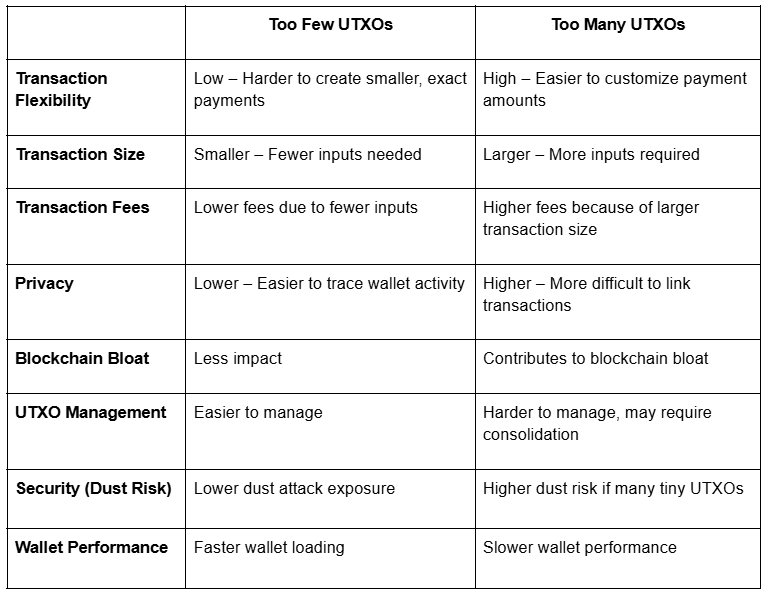

In other words, the ideal UTXO management approach differs from one person to another, as there is a tradeoff with both small and big UTXOs.

In summary,

- Too few UTXOs: Cheaper and faster but less flexible and less private.

- Too many UTXOs: More flexible and private but higher fees, more management overhead, and potential wallet lag.

Buy BTC safely and securely at CoinW.

Good UTXO management techniques

The way you manage our UTXO will determine two critical issues: the transaction fees you incur, and the level of privacy you maintain for your bitcoin wealth.

Consolidating UTXOs

Having many small UTXOs in your wallet can lead to larger transaction sizes and higher fees when you want to spend your bitcoin. To avoid this, it's recommended to periodically consolidate or "combine" your UTXOs into a single larger UTXO by sending the entire balance back to your own wallet address. This reduces future transaction fees by minimizing the number of inputs required.

Timing consolidations

However, It's recommended to consolidate UTXOs during periods of low network fees, as consolidation transactions incur fees based on their data size. Timing consolidations strategically can save on fees.

Managing frequency of your deposits

Let’s say you purchase bitcoin daily on an exchange and immediately transfer it to your self-custody wallet, you might accumulate more UTXOs than desired. Alternatively, you could continue buying bitcoin daily on the exchange but only transfer it to your wallet once a week or bi-monthly. This approach would slow down the accumulation of UTXO.

In Conclusion

To recap, good UTXO is a matter of balance. Consolidating bitcoin into larger UTXOs can offer cost savings on fees, but at the potential expense of privacy. Conversely, dividing bitcoin into smaller UTXO increments can obscure your wallet balance, though it might result in increased transaction fees later on.

Knowing your priorities and how you intend to spend your bitcoins can help you decide on what this balance looks like. Yes, it’s a lot more complicated than keeping your money in the bank, but a wise man once said, “With great power comes great responsibility.”

You May Also Like

What are Liquidity Pools in DeFi?

Here's how liquidity pools work and how you can earn passive income by providing liquidity.

What is cryptocurrency?

A beginner-friendly explanation of what cryptocurrency is, and how it differs from digital cash.

Understanding On-Chain Analysis: A Guide for Crypto Investors

On-chain analysis is a powerful resource for crypto traders who want to trade based on pure hard data, not emotions. Here’s how to do it smart.