What is Blockchain?

Imagine a record-keeping book, not owned or controlled by a single person, but shared and synchronized across a vast network of computers. This shared record book is called a blockchain, in the simplest of terms.

In this article, we break down what blockchain is, how it works, why it's gaining so much traction, its current state of growth, as well as real-life use cases and innovation.

Where did blockchain come from?

The concept of blockchain was first introduced in 2008 by an anonymous person or group using the name Satoshi Nakamoto. It was initially designed as the underlying technology for Bitcoin, the world's first decentralized cryptocurrency. The idea was to create a secure and transparent system for recording and verifying transactions without relying on a central authority like a bank or government.

Core Concepts of Blockchain

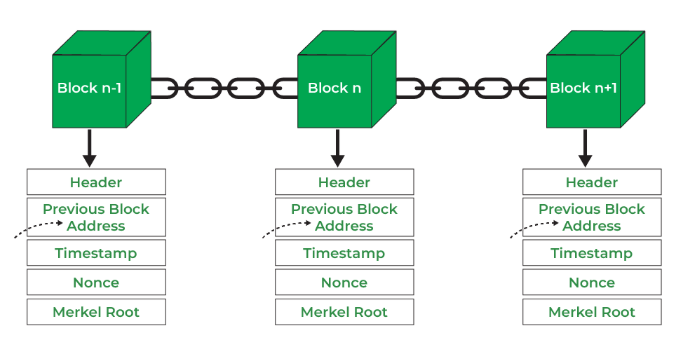

(Source: Geeksforgeeks.org)

Beyond the simplified definition we gave in the introduction, what constitutes a blockchain? Here are some key concepts underpinning this revolutionary technology:

1)Decentralized

Unlike traditional databases controlled by a single entity (like a bank), a blockchain is decentralized. Information is spread across a network of computers (nodes) that all have a copy of the entire ledger. This eliminates the need for a central authority and makes the system more secure and transparent.

2)Data in blocks

Information on a blockchain is stored in blocks, like pages in a ledger. Each block contains data (like transaction details), a timestamp, and a unique cryptographic code linking it to the previous block. This creates a chronological chain of tamper-proof data – the blockchain.

3)Verification by consensus

But how do these separate nodes determine which information to include in a blockchain? New blocks are added through a process called mining. Miners are special nodes that compete to solve complex mathematical puzzles. The winner gets to add the next block to the chain and is rewarded with cryptocurrency (in some blockchains). This process, known as a “consensus mechanism” ensures everyone on the network agrees on the validity of the new information being included in each block.

4)Security by design

Blockchain's security hinges on cryptography, a fancy way of saying it uses code to scramble information. Here's how it works:

5)Cryptographic hashing:

Each block contains a unique cryptographic hash, like a digital fingerprint. This hash is generated using complex mathematical functions and considers all the data in the block, including the previous block's hash. Any change to the data would result in a completely different hash, making it easy to detect tampering.

6)Digital signatures:

Transactions on a blockchain are digitally signed by the involved parties using cryptography. This signature acts like a mathematical proof of authenticity, ensuring only authorized users can initiate transactions.

To sum up, a blockchain is a decentralized digital ledger where data is stored in blocks linked together using cryptography. This distributed system eliminates the need for a central authority, making it secure and transparent. New blocks are added through a competitive process called mining, ensuring data integrity. Cryptography safeguards the blockchain through hashing and digital signatures, making it highly resistant to tampering.

Benefits of blockchain technology

Blockchain technology offers several benefits over traditional centralized data storage systems, particularly in terms of security, privacy, and data integrity. Here are the key advantages:

Security

Blockchain storage is inherently secure due to its decentralized nature. Each transaction is validated by multiple nodes, making it nearly impossible to alter or delete data without detection. This tamper-proof characteristic contrasts with centralized storage, which relies on single points of control that can be vulnerable to hacking and data breaches.

Privacy

Decentralized storage provides enhanced privacy by allowing users to store data without revealing their identity. Transactions on the blockchain are anonymous, and data can be encrypted so that only authorized parties can access it. In contrast, centralized storage requires users to share personal information with the provider, raising concerns about data privacy and security.

Data Integrity and Trust

Blockchain ensures data integrity by maintaining a transparent and immutable ledger. Once data is added to the blockchain, it cannot be altered, which guarantees the accuracy and reliability of the stored data. This creates a trustless environment where third-party intermediaries are not needed to verify data authenticity.

Resilience and Availability

Decentralized storage reduces the risk of data loss or unavailability by distributing data across multiple nodes. This redundancy ensures that even if some nodes fail, the data remains accessible. Centralized systems, on the other hand, have single points of failure that can lead to significant data loss or downtime.

Cost-Effectiveness

While the initial cost of implementing blockchain technology can be high, decentralized storage can become cost-effective over time. It eliminates the need for large investments in data centers and reduces operational costs associated with maintaining centralized servers. Additionally, decentralized storage solutions often offer competitive pricing that can help businesses save on storage costs.

User Control and Data Ownership

Decentralized storage empowers users with more control over their data. Users can monetize their data and have greater ownership rights, unlike centralized storage providers who typically have control over user data. This shift towards user-centric data management aligns with the growing demand for data privacy and autonomy.

Current state of blockchain and applications

Since its inception, blockchain technology has evolved beyond its initial use in cryptocurrencies. Today, it is being explored and implemented in various industries, including finance, supply chain management, healthcare, and government.

But why, though? In a world increasingly inundated with data, consumers are becoming more aware of their data being stored by one central entity (like a bank or credit card company) as it can be hacked (due to a single point of failure) or commercialized (sold to third parties without consumer consent). Equally as important, blockchain data cannot be changed or manipulated, as explained in the preceeding section.

Currently, some notable applications of blockchain being explored include:

- Digital identity: Blockchain can be used to create secure and decentralized digital identities, allowing individuals to control and manage their personal data more effectively.

- Supply chain management: By providing a transparent and immutable record of transactions, blockchain can improve supply chain transparency, traceability, and efficiency.

- Healthcare: Blockchain can enhance data sharing and protection in the healthcare industry. It allows patients to securely manage and share their medical records while maintaining control over their personal data. The MediLedger project uses blockchain to track prescription drugs and prevent the sale of counterfeit medications.

- Voting systems: The decentralized and secure nature of blockchain makes it a potential solution for developing secure and transparent voting systems.

Challenges faced by blockchain technology

Blockchain technology, while promising, faces several hurdles that hinder its widespread adoption. One of the most fundamental challenges is encapsulated in something called the blockchain trilemma.

The blockchain trilemma is a concept that highlights the inherent trade-offs between three key attributes of a blockchain system:

- Decentralization: The network is distributed and operates without a central authority, ensuring transparency and trust.

- Security: Transactions are immutable and resistant to tampering, protecting the integrity of the data.

- Scalability: The network can handle a high volume of transactions efficiently.

Achieving all three of these attributes simultaneously is considered extremely difficult. In practice, blockchain systems tend to prioritize two of these attributes at the expense of the third. For example, even with the OG crypto i.e. Bitcoin, it is highly decentralized and as secure as can possibly with zero hacks or downtime, but it has proven to be not very scalable, as can be seen with the release of the Ordinals.

This is a sticky problem. From the user's perspective, here’s what happens when they use a blockchain that:

- Prioritizes decentralization and security: This often results in slower transaction speeds and higher fees. Users might experience delays in confirming transactions and find the cost of using the blockchain prohibitive for small-value transactions.

- Prioritizes scalability and security: This can compromise decentralization, leading to a more centralized system. While transaction speeds and costs might improve, the system's resistance to censorship and control could be weakened, resulting in the possibility of some users being unable to join a network.

- Prioritizes decentralization and scalability: This typically involves sacrificing security. While the network might be fast and accessible, it could be more vulnerable to attacks and data breaches, resulting in loss of user funds.

Beyond the trilemma, other challenges include:

Interoperability: Different blockchains often have incompatible protocols, making it difficult to transfer assets or data between them.

Regulatory uncertainty: The legal landscape for blockchain is still evolving, creating challenges for businesses and developers.

User experience: Blockchain applications can be complex and difficult for non-technical users to understand and interact with.

While these challenges are significant, ongoing research and development are addressing them. Solutions such as sharding, layer-2 scaling, and improved consensus algorithms are showing promise in enhancing blockchain's performance and usability. Let’s take a closer look at some of these solutions.

On-going blockchain innovations

Layer 2 Solutions

Layer 2 solutions are protocols built on top of an existing blockchain to enhance its scalability and efficiency without compromising the security and decentralization of the base layer. Here are some types of Layer 2s that are being used:

- State Channels: These allow transactions to occur off-chain, significantly increasing transaction speed and reducing fees. Only the opening and closing of the channel is recorded on the main chain. Bitcoin’s Lightning Network is an example of these.

- Sidechains: These are separate blockchains that run in parallel to the main chain, allowing for faster transactions and more complex computations. However, they often require a two-way peg to transfer assets between the main chain and the sidechain, which can introduce security risks. Well-known sidechains include Polygon (MATIC) and Ronin, which specializes in GameFi.

Benefits include improved scalability, lower transaction fees, faster transaction speeds. On the other hand, it can introduce complexities and potential security risks, especially with sidechains.

Cross-Chain Bridges

Cross-chain bridges facilitate the transfer of assets and data between different blockchains. This is crucial for interoperability and to unlock the full potential of the blockchain ecosystem.

- Wrapped Assets: Create tokens on one chain that represent assets on another chain, allowing users to trade and use them across different platforms.

- Atomic Swaps: Directly exchange assets between two blockchains without relying on intermediaries, ensuring security and atomicity.

Cross-chain bridges enable enhanced interoperability, increased liquidity and access to a wider range of assets, but also run security risks, potential for liquidity issues, and regulatory hurdles.

Sharding

Sharding divides a blockchain into smaller fragments, or shards, each handling a subset of transactions or accounts. This approach can significantly improve scalability by allowing multiple shards to process transactions concurrently.

- Horizontal Sharding: Splits the blockchain into multiple shards based on accounts or addresses.

- Vertical Sharding: Divides the blockchain based on transaction types or data.

Sharding unlocks increased scalability and improved transaction throughput. On the other hand, it involves complex implementation, introduces potential security risks as well as centralization.

Rollups

Rollups process multiple transactions off-chain and then submit a compressed summary to the main chain. This significantly reduces the load on the main chain while maintaining security guarantees.

- Optimistic Rollups: Assume that all transactions are valid unless proven otherwise, enabling faster processing but requiring a challenge period.

- ZK-Rollups: Use zero-knowledge proofs to verify the validity of transactions without revealing transaction data,providing higher security and privacy.

Rollups offer high scalability, low transaction fees and improved privacy. However, it also involves complex implementation. There is also the potential for increased latency in optimistic rollups.

In conclusion, each of these solutions offers unique advantages and challenges. The optimal approach often depends on specific use cases and the desired trade-offs between decentralization, security, and scalability. Many blockchains are exploring combinations of these solutions to create hybrid systems that address the blockchain trilemma more effectively.

What is the relationship between blockchain and cryptocurrency?

When talking about blockchain and cryptocurrency, it can be hard to understand how one relates to the other, especially as both involve data and mining. Here’s how:

The relationship between blockchain and cryptocurrency is symbiotic, with blockchain providing a secure, transparent, and decentralized foundation for cryptocurrencies to operate.

In other words, the blockchain is the underlying technology that enables cryptocurrencies to function. It serves as a distributed ledger, recording all cryptocurrency transactions in a secure and immutable manner. Without blockchain, cryptocurrencies would not exist–without the security provided by the blockchains, any cryptocurrency will face the “double spending” problem and thus fail to function as a currency at all.

At the same time, cryptocurrencies have been a driving force behind the development and adoption of blockchain technology. The creation of Bitcoin, the first cryptocurrency, was the catalyst for the emergence of blockchain. In essence, cryptocurrencies form the “value layer” for the blockchain use case.

How so? Each unit of cryptocurrency has economic value e.g. each Bitcoin is valued at $60,000 at time of writing. Bitcoin miners get paid for verifying the transactions happening on its network through the mining reward of bitcoins, which can be sold on the market.

Put another way, cryptocurrency is like the “stock units” of its blockchain, which can in turn be likened to the company. This is why there is a thriving market for crypto trading - depending on how popular or how well-performing it is, its “stock” can be traded on an open market.

In summary, blockchain and cryptocurrency are closely linked, with blockchain providing the foundation for cryptocurrencies to operate, while cryptocurrencies have been instrumental in the development and adoption of blockchain technology for other use cases, as we have seen above.

What are the different types of cryptocurrency?

Beginner’s guide to interacting with the blockchain in 4 steps

Congratulations - if you’ve read this far, you now have a better understanding of blockchain than most people around you. And you guessed it, it’s not just for “crypto bros.” Blockchain is an exciting technology you owe to yourself to learn about. And what better way to learn than a hands-on approach?

Here’s how to get started:

Step 1: Choose Your Blockchain Adventure

There are tons of blockchains out there, each with its own unique use case. Some popular ones include:

- Bitcoin: The OG of cryptocurrencies. Think of it as digital gold.

- Ethereum: The platform for building decentralized apps (dApps). It's like the App Store, but on the blockchain.

- Binance Smart Chain (BSC): A faster and cheaper alternative to Ethereum for dApps.

Step 2: Get Your Digital Wallet

A digital wallet is like your online bank account, but for cryptocurrencies. Popular options include:

MetaMask: A browser extension that works with Ethereum and other compatible blockchains.

Trust Wallet: A mobile app that supports a wide range of cryptocurrencies.

Step 3: Send Your First Transaction

Ready to send some crypto? It's like sending an email, but with money. Here's how:

- Open your wallet: Find the cryptocurrency you want to send.

- Enter the recipient's address: This is like their email address, but for crypto. Double-check it!

- Set the amount: How much do you want to send?

- Pay the fee: Yep, there's usually a small fee to cover the transaction.

- Confirm: Hit send, and your crypto is on its way!

Step 4: Explore the Blockchain World

Now, the fun part! Here are some ideas to get you started:

- Buy some NFTs: These are unique digital items that can be anything from art to trading cards.

- Play blockchain games: Some games let you earn crypto while you play.

- Invest in DeFi: Decentralized finance offers alternatives to traditional banking in terms of lending and borrowing.

- Join a DAO: Decentralized Autonomous Organizations are community-run projects.

Trading 101 in Blockchain

Perhaps the most popular way of interacting with blockchain now is the trading of cryptocurrencies, which can be both exciting and lucrative, but it's essential to approach it with caution and knowledge. Here’s how to get started:

Step 1: Understand the Basics

Learn about different cryptocurrencies, their market trends, and factors influencing their prices. Understand the risks involved and develop strategies to protect your investment.

Step 2: Choose a Reliable Exchange

Compare different crypto exchanges based on fees, security, available coins, and user reviews. Prioritize platforms with strong security measures to protect your funds. Consider transaction fees and withdrawal fees when choosing an exchange.

Step 3: Open an Account and Fund It

Most exchanges require identity verification to comply with regulations. Deposit funds into your exchange account using various payment methods.

Step 4: Start Small and Learn

Spread your investments across different cryptocurrencies to manage risk. Invest a fixed amount regularly, regardless of price, to reduce market timing risks.

Step 5: Develop a Trading Strategy

Study price charts and patterns to predict future price movements. Evaluate the underlying technology, team, and market potential of cryptocurrencies. Determine your comfort level with risk and adjust your trading strategy accordingly.

Step 6: Monitor and Adapt

Keep up with market news and trends. Regularly review your investments and adjust your holdings as needed. The crypto market is dynamic; stay updated with the latest developments. Friendly reminder: Trading involves risks. Never invest more than you can afford to lose. After all, we want to see you thrive for the long-haul and not be burnt out of the game after just a few trades! ;)

In conclusion

Blockchain technology is still evolving, but it has the potential to revolutionize many industries. From secure financial transactions to transparent supply chains, its applications are vast. While cryptocurrencies remain a prominent use case, blockchain's potential extends far beyond just that.

However, challenges like scalability (handling a large volume of transactions), security and regulatory uncertainty still need to be addressed before widespread adoption can occur. At the same time, you can put yourself ahead of the crowd and keep learning about it - start small, experiment, and most importantly, have fun!

You May Also Like

Stablecoin Divergence: USDC vs. USDT

In the world of digital assets, if Bitcoin is digital gold and Ethereum is the global computer, then stablecoins are the "main highways" and "settlement ports" connecting the real-world financial system with the crypto economy.

Altcoin Trading: From Entry to Advanced

In the world of cryptocurrency, if Bitcoin is digital gold and the anchor of the entire market, then Altcoins are the most active, imaginative, and challenging frontier within this ecosystem.

A Comprehensive Guide to DeFi’s Architecture, Yield Mechanisms, and Narrative Evolution

DeFi: Reconstructing finance with code, empowering every individual to be their own bank.