What is Layer 1 Blockchain?

Imagine the blockchain as a digital city—Layer 1 is the bedrock, the roads, and the power grid that keeps everything running smoothly. Without it, all the apps, tokens, and fancy innovations built on top wouldn’t even have a place to live. But what exactly is a Layer 1 blockchain, and why does it matter for crypto newbies and seasoned investors alike?

Layer 1 Blockchains Explained

Before diving into Layer 1 blockchains, here’s a brief overview of what a blockchain is in the first place. Imagine a blockchain as a digital ledger, similar to a notebook, which records all transactions and activities on a network. Each page in this notebook contains a list of transactions, and once a page is full, it's sealed shut forever. These sealed pages form a chain, and hence, the term "blockchain."

Now, let's get to the heart of the matter: Layer 1.

In the world of blockchain technology, Layer 1 solutions serve as the bedrock, the very foundation upon which everything else is built. To better understand this concept, think of Layer 1 as the Earth's crust. Just as the Earth's crust is the outermost layer of our planet and the base upon which ecosystems thrive, Layer 1 is the foundational blockchain network.

Bitcoin and Ethereum are the two biggest Layer 1 blockchains by market cap—and for good reason. As foundational networks, they offer unmatched stability and security, making them the go-to platforms for value transfer (Bitcoin) and decentralized applications (Ethereum). Their decentralized nature and robust consensus mechanisms make them incredibly resilient against attacks, which is why so much of the crypto world is built on top of them.

However, this rock-solid foundation comes at a cost: scalability. This isn't a problem, it's just how it's designed. It's meant to be super secure and unchangeable, since it’s responsible for maintaining the security and consensus of the network, ensuring that all transactions are transparent, immutable, and resistant to censorship or manipulation.

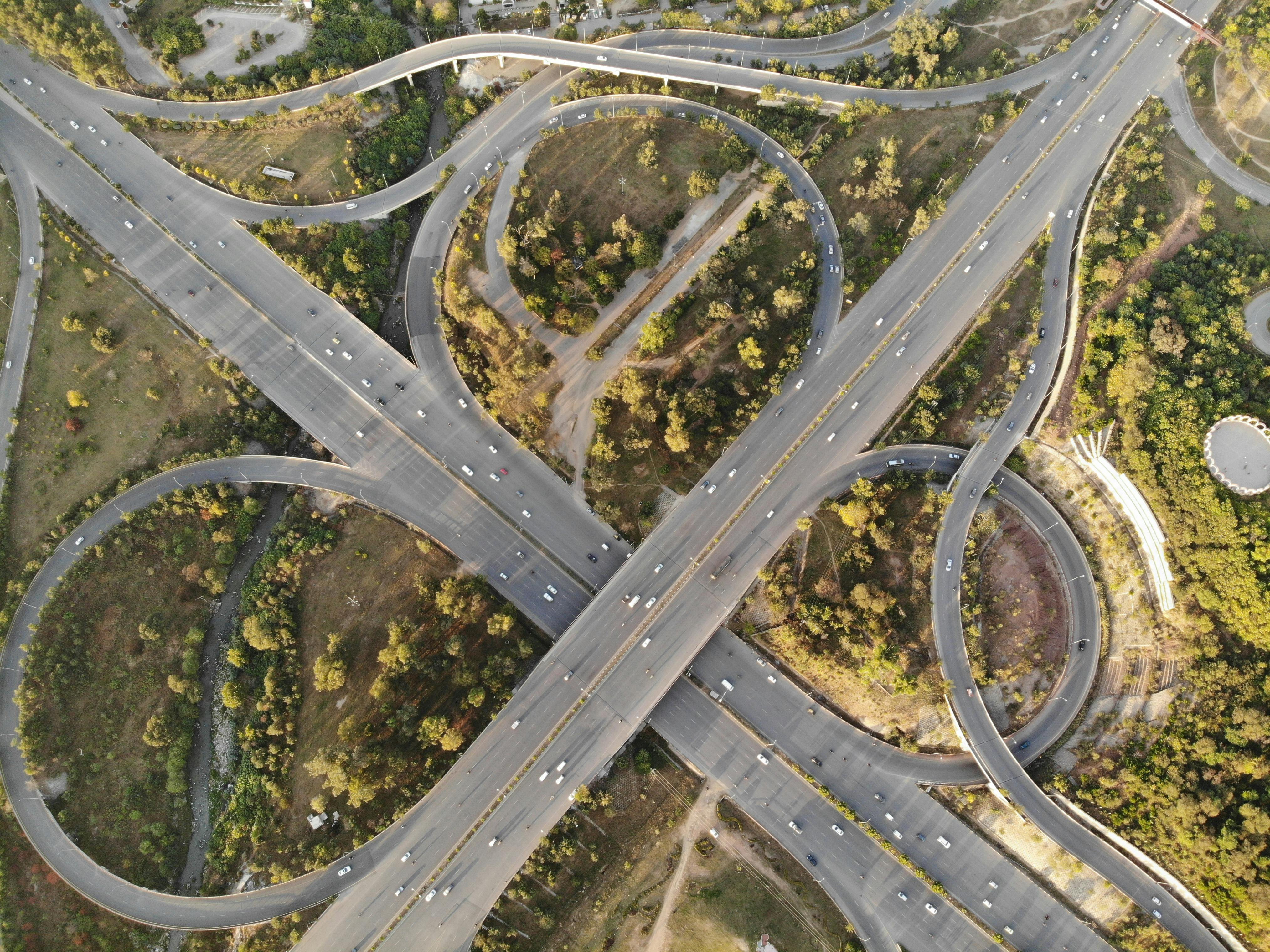

But as more users and applications flood these networks, transaction speeds slow down and fees go up. To do more types of money stuff, we need to set things up in layers, kind of like how regular money systems work. That’s where additional “layers” come in to help handle the growing demand without sacrificing the core strengths of the Layer 1. It’s a bit like adding express lanes to a well-built highway: the foundation stays strong, but traffic keeps moving.

This is what gives rise to Layer 2 solutions like the Lightning Network (for the Bitcoin blockchain), and Polygon, Arbitrum and Optimism (for the Ethereum blockchain). These Layer 2 solutions provide a sort of “expressway” for more transactions to be processed faster and cheaper–without sacrificing the underlying security.

(By the way, regular money systems have layers too. At the bottom, you've got central banks dealing with money and rules. On top, there are banks and money businesses doing things like handling accounts, moving money around, and lending. Payment networks, like credit card companies, are another layer, helping people and businesses trade money. This layering helps each part of the money system do its job well, making everything work better overall.)

How do Layer 1 Blockchains Work?

At its core, a Layer 1 blockchain is the foundational framework that makes everything in the crypto world possible. It handles the most critical functions—like recording transactions, securing data, and maintaining trust—without needing a central authority. Here’s a breakdown of the key features that make Layer 1 blockchains work:

- Security: Layer 1 blockchains are designed to be incredibly secure. Imagine it as a fortress with strong walls and impenetrable defenses. This is achieved through cryptographic techniques and a decentralized network of nodes that validate and record transactions.

- Decentralization: Like a web of interconnected cities, Layer 1 blockchains are distributed across many nodes (computers) worldwide. No single entity or government controls them, making it resilient against any single point of failure.

- Consensus: Layer 1 uses a consensus mechanism, such as Proof of Work (PoW) or Proof of Stake (PoS), to agree on the state of the blockchain. This is akin to a jury of peers deciding whether a transaction is valid or not.

- Immutability: Once a transaction is recorded on Layer 1, it's set in stone, much like ancient hieroglyphics etched into the walls of a pyramid. This ensures that no one can tamper with or erase historical data.

- Transparency: Layer 1 is like a glass building—everyone can see what's happening inside. Every transaction is publicly recorded, providing full transparency to all participants. (This is true for most blockchains, though privacy-focused ones like Monero use special tools like ring signatures to keep transactions more private.)

Layer 1 Blockchain Projects

Layer 1 blockchains don’t just provide the infrastructure—they come with their own built-in currency that keeps the whole system running. These native cryptocurrencies aren’t just for trading or speculation; they’re essential tools used to secure the network, reward participants, and process transactions. Let’s take a look at some of the most well-known Layer 1 blockchain projects and how their native tokens play a vital role in their ecosystems:

- Bitcoin (BTC): The original Layer 1 blockchain and the first cryptocurrency ever created. Bitcoin functions as digital gold—a decentralized, censorship-resistant store of value secured through proof of work. Its native token, BTC, rewards miners and is widely used as a hedge against inflation and economic uncertainty.

- Ethereum (ETH): Often called the “world computer,” Ethereum brought smart contracts into the spotlight. Its Layer 1 network supports thousands of decentralized applications (DApps), from finance to gaming. ETH, the native token, powers the network by paying for gas (transaction fees) and staking, especially since Ethereum’s shift to proof of stake.

- Ripple (XRP): Ripple is a Layer 1 blockchain designed for fast, cost-effective cross-border payments. It acts like a global money highway, primarily used by banks and financial institutions. XRP, its native token, facilitates instant currency conversion and liquidity during international transactions.

- Litecoin (LTC): Often dubbed the silver to Bitcoin’s gold, Litecoin is a Layer 1 blockchain that offers faster block times and a different hashing algorithm. LTC is used for peer-to-peer payments and serves as a lighter, more agile alternative to Bitcoin in everyday transactions.

- Solana (SOL): Solana is a high-performance Layer 1 blockchain known for its blazing-fast transaction speeds and low fees, thanks to a unique hybrid consensus mechanism combining proof of stake with proof of history. SOL, its native token, is used for staking, paying fees, and interacting with a growing ecosystem of DApps and NFTs。

- Avalanche (AVAX): Avalanche is a Layer 1 blockchain designed for scalability and customizability. It supports multiple interoperable blockchains called subnets and uses a novel consensus protocol for quick finality. AVAX, the native token, is used for staking, transaction fees, and securing the network.

Trade popular Layer 1 cryptos at low fees on CoinW.

Conclusion

In the world of blockchain, Layer 1 is the cornerstone upon which trust, security, and decentralization are built. For investors, understanding Layer 1 helps you assess the strength, scalability, and long-term potential of a project—since these blockchains often host other tokens, dApps, and even entire ecosystems. Think of it like real estate: owning a piece of land in a thriving city (Layer 1) is usually more valuable than betting on a shop in a shaky mall (Layer 2 or an app).

For crypto enthusiasts, it’s about knowing where innovation starts—Layer 1s set the rules for security, transaction speed, fees, and decentralization. If you want to make smarter moves, ride trends early, or avoid hype-driven pitfalls, understanding the fundamentals of Layer 1 is your first power-up.

You May Also Like

What are Liquidity Pools in DeFi?

Here's how liquidity pools work and how you can earn passive income by providing liquidity.

What is cryptocurrency?

A beginner-friendly explanation of what cryptocurrency is, and how it differs from digital cash.

What is UTXO in Bitcoin?

Discover what UTXOs are in Bitcoin, how they work, and why they are essential for understanding Bitcoin transactions and wallet balances.