What is Solana?

Solana is a proof-of-history (PoH) blockchain platform designed to be fast, scalable, and secure. It aims to solve the scalability trilemma faced by many existing blockchains, which struggle to achieve high transaction speeds without sacrificing decentralization or security.

Solana was founded in 2017 by Anatoly Yakovenko and Raj Gokal. It launched its mainnet in April 2020 with an initial price of $0.9511. The price reached an ATH of $260.06 in November 2021. Currently, SOL is priced at $76.64, down 70% from its ATH.

What’s Special About Solana?

Solana runs on a Proof of History (PoH) consensus mechanism, using a global clock to timestamp transactions and prevent double spending.

Proof of History (PoH) was introduced by Yakovenko, revolves around recognizing the importance of the chronological order of events within a Blockchain network, asserting that the order holds equal significance to the events themselves. This chronological precision is crucial for maintaining the integrity of the network. PoH achieves this by employing a cryptographic Verifiable Delay Function (VDF) to generate timestamps for each block in the Blockchain.

The VDF poses a formidable challenge for potential adversaries attempting to manipulate timestamps. By integrating the VDF-generated timestamps into each block, PoH establishes a verifiable and immutable record of the transaction order. Notably, PoH enables swift finality, implying that once a block is appended to the blockchain, it attains an irreversible status.

Primarily implemented in the Solana blockchain network, PoH contributes to enhancing the efficiency and speed of the network, enabling Solana to process thousands of transactions per second. This is achieved by concurrently reducing storage and bandwidth requirements while furnishing a secure and verifiable transaction record.

Solana’s Biggest Use Cases

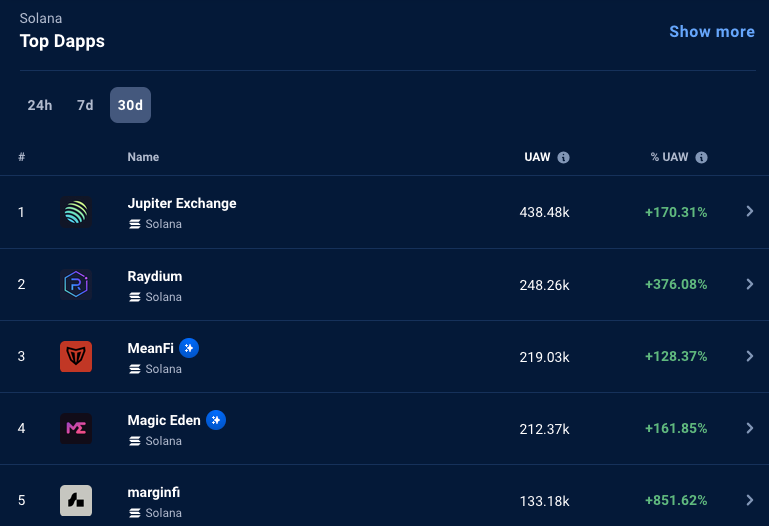

Top dApps on Solana (Source:DappRadar)

Solana’s blockchain platform is designed to host decentralized, scalable applications. Currently, most of these applications are in the DeFi (decentralized finance) space, providing services such as lending, borrowing, and trading. Jupiter Exchange, for example, is a trading platform and Radium, an automated market maker. In addition, Solana is also used for the minting and trading of NFTs.

Solana Controversies and Challenges

Solana's network outages have been a prominent point of discussion and concern in its young history. While it boasts impressive speed and scalability, these past outages raise legitimate questions about its reliability. Here's a brief overview:

Past outages:

- 2022: Solana experienced 14 partial or major outages throughout the year, with the longest lasting almost 17 hours. These outages were attributed to various factors, including software bugs, high transaction volume, and network congestion.

- February 2023: Another major outage occurred in February 2023, lasting nearly 19 hours. This incident further fueled concerns about network stability and caused a significant price drop.

The outages have not only disrupted user experience and caused financial losses but also damaged Solana's reputation and raised questions about its suitability for mission-critical applications. They have also served as ammunition for critics who argue that Solana's focus on speed has compromised its reliability.

In response, Solana's team has acknowledged the shortcomings and actively worked on improving network stability. They have implemented several measures, including codebase improvements to fix bugs and optimize the software to prevent future outages.

In addition, they have developed a new validator client aimed at increasing validator diversity and network redundancy in what is known as the “Firedancer” project. Solana's development team has also continued to make progress on key initiatives, including the Solana Mobile Stack and Wormhole cross-chain bridge.

Since then, Solana has improved its uptime significantly in 2023. With only one major outage since February and maintaining 100% uptime in Q2 and October-December 2023, it shows progress in addressing reliability issues.

Why is it called an "Ethereum Killer"?

Ethereum, while pioneering the smart contract space, has faced criticism for its high transaction fees and slow transaction speed, especially during periods of high network congestion. These limitations can significantly hinder user experience and hinder the wider adoption of blockchain technology.

Solana, on the other hand, boasts significantly faster transaction speeds and lower fees. Its unique Proof-of-History (PoH) consensus mechanism and innovative architecture allow it to process thousands of transactions per second, making it a compelling alternative for developers and users seeking a more efficient and scalable blockchain platform. In fact, in November 2023, Solana hosted more daily active users than Ethereum.

Here’s a breakdown of the key differences between SOL and ETH:

| FEATURES | ETHEREUM | SOLANA |

| Consensus mechanism | Proof-of-Work (PoW) | Proof-of-History (PoH) |

| Transactions-per-second (TPS) | 15-30 | 50,000+ |

| Average transaction fee | $10-20 | $0.0001-0.0003 |

| Smart contract compatibility | EVM-compatible | Not fully EVM-compatible yet |

Solana News and Latest Developments in 2025

Solana has kicked off 2025 with a series of major updates that could reshape its position in the blockchain ecosystem. One of the biggest headlines in Solana news this year is the launch of Solana v2.0, a network upgrade aimed at boosting scalability and reducing transaction fees even further. Early reports show that transaction throughput has improved by over 30%, cementing Solana’s reputation as one of the fastest blockchains in the market.

In addition to technical improvements, Solana’s developer community is seeing a surge in activity. Several high-profile DeFi protocols and NFT marketplaces have migrated or expanded to Solana in 2025, attracted by its low costs and high speed. This has contributed to a steady rise in daily active users and trading volumes across the network.

On the ecosystem side, Solana has also announced new strategic partnerships, including collaborations with major Web3 gaming studios and cross-chain bridge providers. These moves are designed to strengthen interoperability and tap into the growing blockchain gaming market.

But is Solana TRULY an "Ethereum Killer"?

While Solana has made significant progress in addressing some of Ethereum's limitations, it's still too early to say definitively whether it will replace Ethereum as the dominant smart contract platform. Ethereum is still the most widely used platform with a larger ecosystem of dApps and developers. Moreover, Ethereum is actively working on its own scalability solutions through Ethereum 2.0, which promises significant improvements to its network performance.

However, Solana's potential is undeniable. Its speed, scalability, and low fees make it a compelling choice for many applications. Its growing developer community and ecosystem are also encouraging signs for its future success.

Conclusion

Whether Solana ultimately surpasses Ethereum remains to be seen. Its future success will depend on its ability to maintain its performance. Continued development efforts, a strong focus on network stability, and building trust with the community will be crucial for its long-term success.

However, there's no doubt that it has emerged as a major contender in the smart contract space. Its innovative technology and strong community position it as a force to be reckoned with, and its impact on the future of blockchain technology will be significant.

Buy SOL safely and easily on CoinW.

You May Also Like

What Is Babylon (BABY)? Bitcoin Staking & Shared Security Explained

Learn how Babylon (BABY) leverages Bitcoin as a security anchor to power Bitcoin staking and shared security models, including token utility, risks, and long-term outlook.

What Is Particle Network (PARTI)? Multi-Chain UX Explained

Learn how Particle Network (PARTI) targets multi-chain friction with account and chain abstraction—onboarding, cross-chain flows, token role, and key risks to watch.

What Is RFC (Retard Finder Coin)? Complete Guide

Explore RFC (Retard Finder Coin), its meme-driven model, tokenomics, market dynamics, risks, and how it fits into the speculative crypto landscape.